Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday. 1. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action. China put a 10% level on 1700 US goods. No date has been given for the next round of face-to-face talks that were expected this...

Read More »September Monthly

Three forces are shaping the investment climate. The US-China trade conflict escalates at the start of September as both will raise tariffs on each other’s goods and are threatening another round in mid-December (US 25% tariffs on $250 of Chinese imports will increase to 30% on October 1). Some third parties may benefit from the re-casting of supply chains, but the first impact is understood to weaken growth impulses. That is aggravating the slowdown already evident...

Read More »FX Daily, August 30: US Dollar Finishing August on Firm Note as Euro nears Two-Year Lows

Swiss Franc The Euro has fallen by 0.03% to 1.0903 EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are advancing at least in part on ideas that trade tensions are easing. China announced it would not take immediate action on the five percentage point increase in levies that the US announced strictly in response to China’s retaliatory tariffs. A lull between...

Read More »FX Daily, August 29: Johnson Faces Legal Challenges and Conte may be Given an Extension

Swiss Franc The Euro has risen by 0.14% to 1.0887 EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are calm today, though there does seem to be some optimism creeping back into the market. The Chinese yuan strengthened, snapping a ten-day slide and Italian bank shares index has risen by more than 1% for the fourth consecutive session. The safe-haven yen and...

Read More »FX Daily, August 28: Optimism about Italy Creeps Back in but Sterling Heads the Opposite Way on Brexit Realities

Swiss Franc The Euro has fallen to 1.0872 or by 0.09%. EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets have turned quiet. There have been no more headline bombs about trade, and China set the dollar’s reference rate much lower than projected. Asia Pacific equities were mixed. Hong Kong, China, India, and Singapore were on the downside, while Taiwan,...

Read More »FX Daily, August 27: Realism Fights Back After Hope Dominated Yesterday

Swiss Franc The Euro has risen by 0.44% to 1.0912 EUR/CHF and USD/CHF, August 27(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Hope triumphed over realism yesterday, and realism is fighting back toward. Asia Pacific markets, however, traded on the echo from the recovery in North America on Monday. The MSCI Asia Pacific recouped part of yesterday’s drop, led by Chinese markets. Hong Kong was the main...

Read More »FX Daily, August 26: Trump’s “Call from China” helps Markets Recover

Swiss Franc The Euro has risen by 0.11% to 1.0873 EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The anticipated growth implications of the heightened tensions between the world’s two largest economies is dominating activity at the start of the new week. These considerations that drove the 2.6% drop in the S&P 500 before the weekend is carrying over into today’s...

Read More »FX Weekly Preview: The Week Ahead is not about the Week Ahead

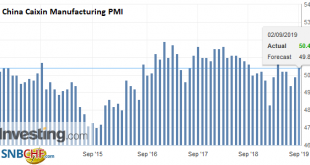

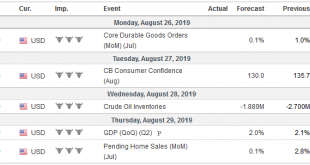

It’s the last week of August. Several economic reports will be released in the coming days. They include the US deflator of consumer expenditures that the Federal Reserve targets, China’s PMI, and the eurozone’s preliminary August CPI. It is not that the data do not matter, but investors realize the die is cast. They are looking further afield. The next US tax increase on Chinese imports goes into effect on September 1, and Beijing has threatened to retaliate. The...

Read More »FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

Swiss Franc The Euro has fallen by 0.07% to 1.0887 EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and...

Read More »FX Daily, August 22: Tick Up in EMU PMI Does Little, Waiting for Powell

Swiss Franc The Euro has risen by 0.17% to 1.0905 EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday’s 1.2% advance despite an unexpected gain in the EMU flash PMI....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org