Swiss Franc The Euro has risen by 0.12% at 1.1275 EUR/CHF and USD/CHF, May 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped...

Read More »FX Daily, May 20: Politics Overshadows Economics Today, but Japan’s Economy Unexpectedly Expanded in Q1

Swiss Franc The Euro has fallen by 0.11% at 1.1261 EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Encouraged by the election results, investors bid up Indian and Australian currencies and equities. Japan offered a pleasant surprise by reporting the world’s third-largest economy expanded in Q1. Most other equity markets in Asia...

Read More »FX Daily, May 17: China Questions US Sincerity

Swiss Franc The Euro has risen by 0.04% at 1.1285 EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the...

Read More »FX Daily, May 16: US Struggles to Strike a Less Strident Tone

Swiss Franc The Euro has risen by 0.02% at 1.1299 EUR/CHF and USD/CHF, May 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Retail sales and industrial production disappointed in both the US and China prior to the end of the tariff truce, declared by the US in a series of presidential tweets on May 5. The reaction function of the US to the drop in equities was...

Read More »FX Daily, May 15: Angst Continues

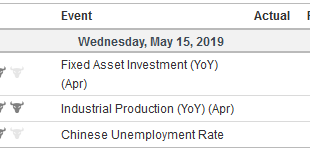

Swiss Franc The Euro has fallen by 0.28% at 1.1273 EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: merkets.ft.com - Click to enlarge FX Rates Overview: Disappointing Chinese April data spurred speculation that more stimulus will be forthcoming and bolsters hopes that a trade deal with the US by the end of next month helped Asian Pacific equities advance for the first time this week....

Read More »Why China Finds it Difficult to Weaponize the Yuan and US Treasuries

It looks so easy on paper. China can sell its holding of US Treasuries and/or weaken the yuan to offset the tariffs and boost exports. It is the first and easy answers from strategists, journalists, and some academics. Often times, it is presented a novel idea; as if diplomats, investors, and policymakers have not thought it. The point is not that China cannot sell its Treasury holding or that it cannot devalue the...

Read More »FX Daily, May 14: Too Weak to Muster Much of a Turnaround Tuesday, Markets See Small Reprieve

Swiss Franc The Euro has risen by 0.09% at 1.1304 EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s willingness to meet China’s Xi at the G20 meeting at the end of next month and his “feeling” that an agreement will still be found seemed sufficient to break the momentum that had swept through the capital market....

Read More »FX Daily, May 13: Investors Still Looking for New Balance

Swiss Franc The Euro has fallen by 0.53% at 1.131 EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The end of the tariff truce between the US and China has discombobulated investors. They had been repeatedly that a deal was close and there had even been talk at the US Treasury about where Trump and Xi should meet to sign the...

Read More »FX Weekly Preview: Trade, the Dollar, and the Week Ahead

China is isolated on trade. No one supports its trade practices. The idea that China was going to “naturally” evolve to be more like the US, or Europe for that matter, was always fanciful and naive. The emergence of China, as Napoleon warned two centuries ago, would make the world shake. US administrations adopted a multi-prong strategy of managing the rise of China. On economic issues, the focus was on working through...

Read More »FX Daily, May 10: Waiting for the Other Shoe to Drop

Swiss Franc The Euro has fallen by 0.08% at 1.1372 EUR/CHF and USD/CHF, May 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Contrary to hopes and expectations, the US made good on the presidential tweet and raised the tariff on around $200 bln of Chinese goods from 10% to 25%. Trump indicated that the process that will levy a 25% tariff on the remaining Chinese...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org