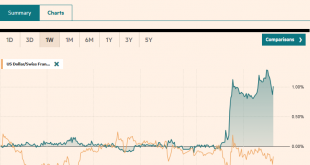

Swiss Franc The Euro has fallen by 0.10% to 1.0768 EUR/CHF and USD/CHF, October 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The on-again-off-again fiscal stimulus in the US is back on as the White House now supports a broad stimulus program, but not as big as the Democrats $2.2 trillion package. It is the narrative being cited as the rebuilding of risk appetites is the wobble earlier in the week. Chinese...

Read More »FX Daily, October 1: Hope Springs Eternal

Swiss Franc The Euro has fallen by 0.10% to 1.0779 EUR/CHF and USD/CHF, October 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Speculation that a new round of fiscal stimulus from the US is possible is encouraging risk-taking today. Many large Asian centers were closed for holidays today, and a technical problem prevented the Tokyo Stock Exchange from opening. Nevertheless, the markets that were open rose by...

Read More »FX Daily, September 25: Sentiment Remains Fragile Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.13% to 1.0801 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic week is finishing on a quieter note. The modest gains in US equities yesterday helped the Asia Pacific performance today. Most markets but China and Hong Kong pared the weekly losses, and easing regulations in Australia spurred a rally in financials that saw its stock...

Read More »FX Daily, September 16: Dollar Eases Ahead of the FOMC

Swiss Franc The Euro has fallen by 0.04% to 1.0751 EUR/CHF and USD/CHF, September 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has been sold against nearly all the world’s currencies ahead of what is expected to be a dovish Federal Reserve, even if no fresh action is taken. The Scandis and Antipodean currencies are leading the majors. The South African rand and Mexican peso are leading the...

Read More »FX Daily, September 15: The Dollar Softens Ahead of the FOMC

Swiss Franc The Euro has fallen by 0.19% to 1.0755 EUR/CHF and USD/CHF, September 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are relatively quiet so far today as the FOMC meeting gets underway. Equity markets in the Asia Pacific region, but Japan and Australia advanced, and the regional benchmark rose for the fourth consecutive session. European stocks are a little firmer. The...

Read More »FX Daily, July 8: Consolidation is the Flavor of the Day

Swiss Franc The Euro has risen by 0.12% to 1.063 EUR/CHF and USD/CHF, July 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500’s longest advance this year was stopped seemingly as concern that the flare-up in the virus will slow the recovery. The sell-off in airlines and hotels helped spur a broader bout of profit-taking. Most Asia Pacific bourses advanced, led by the continued rally in Hong Kong...

Read More »FX Daily, June 23: Weebles Wobble but they Don’t Fall Down

Swiss Franc The Euro has risen by 0.22% to 1.069 EUR/CHF and USD/CHF, June 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However,...

Read More »FX Daily, May 19: Optimism Burns Eternal

Swiss Franc The Euro has risen by 0.08% to 1.0601 EUR/CHF and USD/CHF, May 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Hopes for a vaccine and a German-French proposal to break the logjam at the EU for a joint recovery effort helped propel equities higher yesterday. There was strong follow-through in the Asia Pacific region, where most markets advanced by more than 1% today. However, the bloom came off...

Read More »FX Daily, May 4: Monday Blues

Swiss Franc The Euro has fallen by 0.11% to 1.054 EUR/CHF and USD/CHF, May 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The constructive mood among investors in April has given way to new concerns as May gets underway. Japan and China are still on holiday, but most of the other markets in Asia fell, led by 4.5%-5.5% declines in Hong Kong and India, and more than 2% in most other local markets. Australia...

Read More »FX Daily, March 26: Rumor Bought, Fact Sold

Swiss Franc The Euro has fallen by 0.03% to 1.0623 EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Speculation that the US Senate would pass the large stimulus bill worth around 10% of US GDP is thought to have fueled a bounce in equities in recent days. The bill was approved and will now go to the House, where a vote is expected tomorrow. If the rumor was bought, the fact has been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org