There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report. The BLS reported Friday,...

Read More »Three Things About Today’s UST Sell-off, Beginning With Fedwire

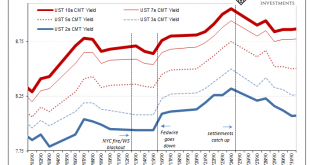

Three relatively quick observations surrounding today’s UST selloff. 1. The intensity. Reflation is the underlying short run basis, but there is ample reason to suspect quite a bit more than that alone given the unexpected interruption in Fedwire yesterday. At 12:43pm EST, most of FRBNY’s electronic services experienced an as-yet unexplained problem which interrupted service, including that of Fedwire. To this point, the New York branch has only confirmed the...

Read More »Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery. Of course, anyone who’s been paying attention knows that rates have been rising for almost a year –...

Read More »Monthly Macro Monitor – September 2020

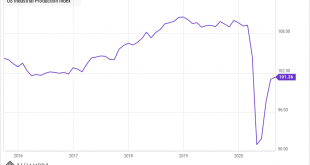

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end. 2nd quarter was a giant downdraft and 3rd quarter saw an initial rapid climb out the giant hole dug by the shutdowns (an own goal of epic...

Read More »Monthly Macro Monitor: Market Indicators Review

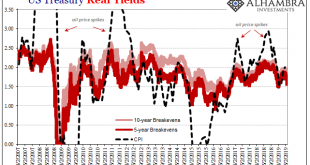

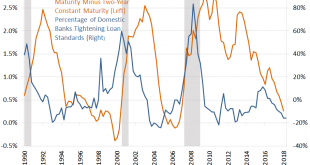

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations. The yield curve has also steepened as the 10 year Treasury yield rose faster than the 2 year. This...

Read More »Just Who Was The Intended Audience For The Rate Cut?

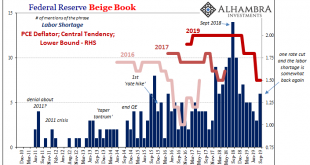

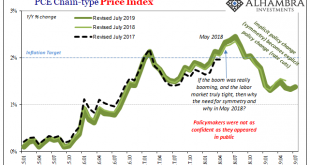

Federal Reserve policymakers appear to have grown more confident in their more optimistic assessment of the domestic situation. Since cutting the benchmark federal funds range by 25 bps on July 31, in speeches and in other ways Chairman Jay Powell and his group have taken on a more “hawkish” tilt. This isn’t all the way back to last year’s rate hikes, still a pronounced difference from a few months ago. The common forecast relies entirely on the subjective...

Read More »Big Difference Which Kind of Hedge It Truly Is

It isn’t inflation which is driving gold higher, at least not the current levels of inflation. According to the latest update from the Bureau of Economic Analysis, the Federal Reserve’s preferred inflation calculation, the PCE Deflator, continues to significantly undershoot. Monetary policy explicitly calls for that rate to be consistent around 2%, an outcome policymakers keep saying they expect but one that never happens. For the month of July 2019, the index...

Read More »Monthly Macro Monitor: Market Indicators Review

This is a companion piece to last week’s Monthly Macro report found here. The Treasury market continues to price in lower nominal and real growth. The stress, the urgency, I see in some of these markets is certainly concerning and consistent with what we have seen in the past at the onset of recession. The move in Treasuries is by some measures, as extreme as the fall of 2008 when we were in a full blown panic. That to me, is evidence that this move is overly...

Read More »Janus Powell

Again, who’s following who? As US Treasury yields drop and eurodollar futures prices rise, signaling expectations for lower money rates in the near future, Federal Reserve officials are catching up to them. It was these markets which first took further rate hikes off the table before there ever was a Fed “pause.” Now that the Fed is paused, it’s been these same markets increasingly projecting not just a rate cut or two...

Read More »Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org