Here's the latest sign that the massively fraudulent ICO market is headed for a collapse. Tezos’s investors are still waiting to learn when they can expect to receive the digital tokens that they paid a premium for during the company’s record-setting crowdsale. But as reports of abuse, internal strife and outright embezzlement have surfaced in the press, three groups of angry investors have filed class action lawsuits accusing the company of fraud and securities violations. In...

Read More »Demographic Dysphoria: Swiss Village Offers Families Over $70,000 To Live There

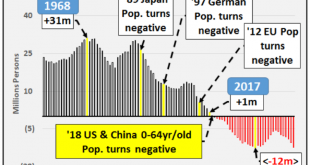

Across the world, demographic dysphoria is taking shape, creating numerous headaches for governments. To avoid the next economic downturn, governments are searching for creative measures to increase population growth and deliver a sustainable economy. In Europe, a near decade of excessive monetary policy coupled with a massive influx of refugees have not been able to reverse negative population growth– first spotted in...

Read More »New Gold-Backed Debit Card Launched In Partnership With MasterCard

In recent years, there has been a major debate about the respective merits of gold versus Bitcoin, even though many, not all, gold bulls are also supporters of the latter. Gold advocates generally view favourably Bitcoin’s inherent characteristics of decentralisation, finite supply and ability to operate (so far) outside of the usual interference by western central banks. Having said that, the launch of Bitcoin futures...

Read More »For The First Time Ever, The “1%” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank’s infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past year, suggests that the lower...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe – Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis – Venezuela’s new 100,000-bolivar note is worth less oday thehan USD 2.50 – Maduro announces plans to eliminate all physical cash – Gold rises in response to ongoing crises One Hundred Trillion Dollars Zimbabwe - Click to enlarge A military coup-de-grace in Zimbabwe...

Read More »Frontrunning: November 15

GOP Seeks to Derail Moore, Salvage Senate Seat (WSJ) Army takes control in Zimbabwe (Reuters) Senate Tax Plan Guts Obamacare, Sunsets Many Middle-Class Cuts (BBG) Senate Republicans tie tax plan to repeal of key Obamacare mandate (Reuters) Trump’s Campaign Foreign Policy Team Under Mueller’s Microscope (BBG) Ryan Says Future Congresses Will Preserve Tax Bill’s Temporary Measures (BBG) Shareholders take aim at Murdochs with Fox voting rights push (Reuters) AT&T Engages Its Washington...

Read More »If American Federalism Were Like Swiss Federalism, There Would Be 1,300 States

In a recent interview with Mises Weekends, Claudio Grass examined some of the advantages of the Swiss political system, and how highly decentralized politics can bring with it great economic prosperity, more political stability, and a greater respect for property rights. Since the Swiss political system of federalism is itself partially inspired by 19th-century American federalism, the average American can...

Read More »When Health Insurance Works: A Look Inside Switzerland’s Healthcare System

[Part of a series on the Swiss economy and society.] The enigmatic independence of Switzerland is perhaps best demonstrated in the fact that its healthcare system manages to satisfy both free marketers and the statist-socialists in the country. It is a giant social safety net woven by individual responsibility and self-made wealth. Health insurance is almost entirely consumer-based, though there are strict cantonal...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org