Swiss Franc The Euro has risen by 0.05% at 1.1106 EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Quarter-end positioning seems to dominate today’s activity. The outcome of bilateral talks at the G20 gathering partly reflects the influence of the US President who eschews multilateral efforts as a hindrance to its sovereignty. Equities...

Read More »FX Daily, June 03: US Penchant for Tariffs Keeps Investors on Edge

Swiss Franc The Euro has risen by 0.04% at 1.1181 . FX Rates Overview: The weekend failed to break the grip of investor worries that is driving stocks and yields lower. The US Administration’s penchant for tariffs is not simply aimed at China, where there is some sympathy, but the move against Mexico, dropping special privileges for India, and apparently, had considered tariffs on Australia. At the same time, the...

Read More »FX Daily, April 25: Equities Waiver, the Dollar Does Not

Swiss Franc The Euro has fallen by 0.12% at 1.1364 EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After closing at record highs on Tuesday, the S&P 500 slipped yesterday, and the Dow Jones Stoxx 600 snapped an eight-session advance. Asia followed suit, with the Shanghai Composite posting its biggest loss (~2.4%) in over a...

Read More »FX Daily, June 12: US-Korea Summit Fails to Impress Investors

Swiss Franc The Euro has risen by 0.03% to 1.1609 CHF. EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar initially rallied in early Asia ahead of the US-North Korea summit but has subsequently shed the gains and more. As North American dealers return to their desks, the dollar is lower against nearly all the major...

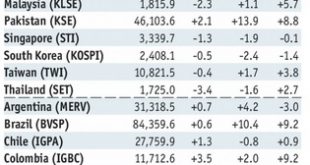

Read More »Emerging Markets: What Changed

Summary Reserve Bank of India cut its inflation forecast for the first half of FY2018/19 to 4.7-5.1%. Former South Korean President Park was sentenced to 24 years in prison. Malaysia Prime Minister Razak has called for early elections. Bahrain discovered its biggest oil field since it started producing crude in 1932. Local press reports Turkey’s Deputy Prime Minister Simsek tendered his resignation. Brazilian Supreme...

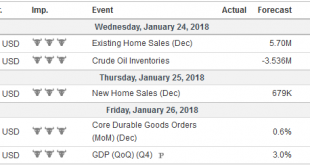

Read More »FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore. Another weight on...

Read More »“Under Any Analysis, It’s Insanity”: What War With North Korea Could Look Like

Now that the possibility of a war between the US and North Korea seems just one harshly worded tweet away, and the window of opportunity for a diplomatic solution, as well as for the US stopping Kim Jong-Un from obtaining a nuclear-armed ICBM closing fast, analysts have started to analyze President Trump’s military options, what a war between the US and North Korea would look like, and what the global economic...

Read More »FX Daily, August 03: Dollar-Bloc Currencies Turning, but Euro Downticks Limited

Swiss Franc The Euro has fallen by 0.10% to 1.1496 CHF. EUR/CHF and USD/CHF, August 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US...

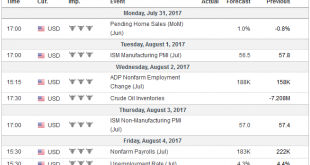

Read More »FX Daily, July 31: Monday Morning Blues

Swiss Franc The euro is up by 0.15% to 1.1385 CHF EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying a respite from the recent selling, but its gains have been shallow, and will likely prove brief. The upticks have been concentrated in the recently high-flying dollar-bloc currencies, and sterling. The tone appears to be...

Read More »FX Weekly Preview: The Dollar may Need more than a Strong Employment Report

Summary: For the US jobs data to rally the dollar, it needs to increase the likelihood of a Fed hike in September, a high bar. The BOE will stand pat, a 6-2 vote would likely be accompanied by a hawkish inflation report. The RBA will also hold rates steady, and of course, it would prefer a weaker currency. The tide of sentiment has turned against the dollar. The enthusiasm seen in the second part of last year,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org