Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year. The 10-year Treasury yield rose from 2.97% to 4% just a few days before the end of the quarter. The 3-7 year Treasury index – our...

Read More »Putin and Powell Lift Dollar

Overview: Between Putin’s mobilization of 300k Russian troops and Fed Chair Powell expected to lead the central bank to its third consecutive 75 bp hike later today, the dollar rides high. It has recorded new two-year highs against the dollar bloc and Chinese yuan, while sterling was sent to new lows since 1985. Asia Pacific bourses were a sea of red for the sixth decline in the regional benchmark in the past seven sessions. Surprisingly, Europe’s Stoxx 600 is...

Read More »The Greenback Firms to Start the New Week, Stocks Slide

Overview: The busy week is off to a slow start as Japan is on holiday and the UK and Canadian markets are closed to honor Queen (Australia will commemorate with a holiday on Thursday). Nevertheless, the sell-off in equities continues and the US dollar is firm. Most of the large markets in Asia fell. India is a notable exception. Its benchmark rose for the first time in four sessions, helped by bank shares and Infosys. Europe’s Stoxx 600 is off for the fifth...

Read More »The Russians (Propaganda) Are Coming!

The headline reads “Moscow World Standard to Destroy LBMA’s Monopoly in Precious Metals Pricing”. Wow! Could it be? Is this it?! The gold revaluation we’ve all been waiting for! Someone, who has the power, will give us a venue in which we can sell our gold at its true price… how does $50,000 sound, eh? Not so fast. Betting Against the Incumbent? For one thing, there are sanctions. If you’re a citizen of a Western country, there is a legal barrier between you and a...

Read More »Careful about Chasing the Dollar Lower in North America Today

Overview: The bout of profit-taking on long dollar positions begun last week has carried into the start of this week. Despite the escalating rhetoric, the yen is not participating today and is trading within the pre-weekend ranges. The greenback’s lows have been set in the European morning and have stretched the intraday momentum indicators, suggesting that North American dealers may not follow suit. The uncertainty about the Swedish election outcome has not...

Read More »US Dollar Soft while Consolidating Yesterday’s Drop

Overview: The US dollar is consolidating yesterday’s losses but is still trading with a heavier bias against the major currencies and most emerging market currencies. The US 10-year yield is soft below 2.77%, while European yields are mostly 2-4 bp higher. The peripheral premium over the core is a little narrower today. Equity markets, following the US lead, are higher today. The Hang Seng and China’s CSI 300 rose by more than 2% today. Europe’s Stoxx 600 gained...

Read More »Greenback Jumps Back

Overview: With the exception of Japan, Taiwan, and India, the large equity markets in the Asia Pacific region traded higher today. The Hang Seng led the move (1.65%) amid reports that Alibaba will seek its primary listing there. Europe’s Stoxx 600 is edging higher today. If it can hold on to the gains, it will be the fourth consecutive rise, the longest advance since May. US futures are slightly under water. Benchmark 10-year yields are mostly lower, with the US off...

Read More »Market Prices in More Aggressive Fed AND is more Confident of Rate Cuts by the End 2023

Overview: The higher-than-expected US CPI and the strong expectation of a 100 bp hike by the Fed in two weeks is propelling the dollar higher. It jumped to almost JPY139.40 and the euro is off more than cent from yesterday's high (though holding above parity). Even where there has been favorable economic news, like the strong jobs report in Australia, is failed to dent the greenback. Most of the large bourses in the Asia Pacific regions advanced. Hong Kong is a...

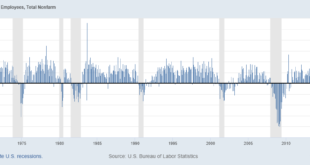

Read More »Weekly Market Pulse: A Most Unusual Economy

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

Read More »The Dollar Jumps and the Euro Slips under $1.03

Overview: The dollar is soaring today, and the euro is trading at new 22-year lows having traded below $1.03. Even a 50 bp hike by the Reserve Bank of Australia has failed to prevent a sharp drop in the Australian dollar. The session seemed to have begun off well enough. Japan, South Korean, Taiwan, Australian, and Indian shares advanced in the Asia Pacific region. Europe’s Stoxx 600 began off firmly, but quickly unwound yesterday’s 0.55% gain. US futures are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org