As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business. From what little most people know about that essential business, it seems like it has something to do with that thing called SWIFT. Thus,...

Read More »Russia’s Military Action Shakes Markets

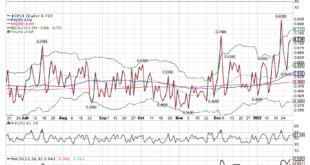

Overview: News that the separatists were calling on Moscow for military assistance began the risk-off move, and Russia hitting targets across Ukraine has rippled across the capital markets. Equites have been upended. Most bourses in the Asia Pacific region were off 2%-3%, while the Stoxx 600 in Europe gapped lower and is off around 3.5% in late morning dealings. It is at the lowest level since May last year. US futures are sharply lower, and the S&P 50 is...

Read More »The Red Warning

Now it’s the Russian’s fault. Belligerence surrounding Donbas and Ukraine, raw materials and energy supplies to Europe threatened by Putin’s coiled bear. Why wouldn’t markets grow worried? There’s always a reason why we shouldn’t take these things seriously, or quickly dismiss them out of hand as the temporary product of whichever political fear-of-the-day. This isn’t to write that these things aren’t important in any sense; no doubt anyone in or near Ukraine right...

Read More »Weekly Market Pulse: Are We There Yet?

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness. I know a lot of people liked that rally into the close on Friday and it was a nice way to end a wild week but it also shows that traders/investors are all too...

Read More »Inflation and Geopolitics in the Week Ahead

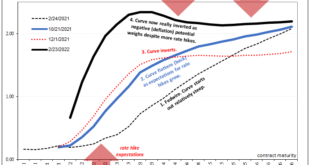

The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month. While the tribalist approach, exemplified by “team transition” and “team permanent” debates about inflation, the...

Read More »FX Daily, December 6: Semblance of Stability Returns though Geopolitical Tensions Rise

Swiss Franc The Euro has risen by 0.26% to 1.041 EUR/CHF and USD/CHF, December 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The absence of negative developments surrounding Omicron over the weekend appears to be helping markets stabilize today after the dramatic moves at the end of last week. Asia Pacific equities traded heavily, and among the large markets, only South Korea and Australia escaped unscathed...

Read More »The Greenback Slips to Start the New Week

Overview: While the Belarus-Poland border remains an intense standoff, there have been a couple other diplomatic developments that may be exciting risk appetites today. First, Biden and Xi will talk by phone later today. Second, reports suggest the UK has toned down its rhetoric making progress on talks on the implementation of the Northern Ireland Protocol. Equities in the Asia Pacific region were mostly firmer, with China a notable exception among the large...

Read More »Dollar Slumps

Overview: While equities and bonds are firmer, it is the dollar's sell-off that stands out today. The greenback has retreated broadly. The euro is trading above the previous week's high for the first time in over a month, and the dollar was pushed back below JPY114.00 in early European turnover. The Chinese yuan is at four-month highs. The Antipodean and Scandi currencies are leading the move against the dollar among the major currencies. The JP Morgan Emerging...

Read More »What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%. Taiwan got tagged for 2%, and Japan's Topix was off 1%. Hong Kong and South Korean markets were closed. Europe's Dow Jones Stoxx 600 is firmer for the second day but is still lower for the week. US indices...

Read More »How (Not) to Win Friends and Influence People

How (Not) to Win Friends and Influence People Overview: There are two big themes in the capital markets today. The first is the ongoing push of the Chinese state into what was the private sector. Today’s actions involve breaking Ant’s lending arms into separate entities, with the state taking a stake. This weighed on Chinese shares and Hong Kong, where many are lists. On the other hand, Japanese markets extended their recent gains. The Nikkei, for example, is has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org