Overview: The dollar is consolidating yesterday's advance and is confined to fairly narrow ranges in quiet turnover. Most of the major currencies are within 0.1% of yesterday's close near midday in Europe. The $1.1700-level held in the euro. Most emerging market currencies have edged a little higher. Despite the largest fall in the US NASDAQ in three weeks and the largest fall in the S&P 500 in a month, the MSCI Asia Pacific Index rose for the first time in...

Read More »FX Daily, July 14: RBNZ Moves Ahead of the Queue, Will the Bank of Canada Maintain its Place?

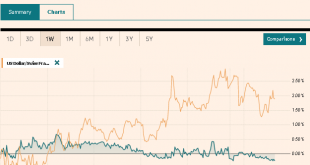

Swiss Franc The Euro has risen by 0.18% to 1.0833 EUR/CHF and USD/CHF, July 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Reserve Bank of New Zealand jumped to the front of the queue of central banks adjusting monetary policy by announcing the end of its long-term asset purchases. New Zealand’s s 10-year benchmark yield jumped seven basis points, and the Kiwi is up almost 1%, to lead the move against...

Read More »FX Daily, July 13: Headline US CPI may Decline for the First Time in a Year

Swiss Franc The Euro has fallen by 0.18% to 1.0831 EUR/CHF and USD/CHF, July 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: New record highs in the US S&P 500 and NASDAQ coupled with China allowing Tencent to acquire a search engine helped lift Asia Pacific equities. It is the first back-to-back by MSCI’s regional index for more than two weeks. Australia’s market was a notable exception. The lockdown...

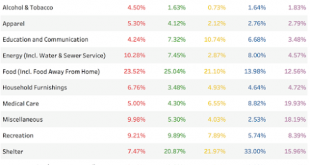

Read More »Measuring Inflation and the Week Ahead

There is quite an unusual price context for new week’s economic events, which include June US CPI, retail sales, and industrial production, along with China’s Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan. In addition, the US Treasury will sell $120 bln in coupons while the US earned income tax credit and the child tax credit is rolled out. The dollar surged even while interest rates fell. The US 10-year yield...

Read More »FX Daily, May 26: RBNZ Joins the Queue, while Yuan’s Advance Continues

Swiss Franc The Euro has fallen by 0.13% to 1.0953 EUR/CHF and USD/CHF, May 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Daily Overview: The decline in US rates and the doves at the ECB pushing back against the need to reduce bond purchases next month have seen European bond yields unwind most of this month’s gain. The inability of US shares to hold on to early gains yesterday did not deter the Asia Pacific and...

Read More »FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Swiss Franc The Euro has fallen by 0.01% to 1.0541 EUR/CHF and USD/CHF, March 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and...

Read More »FX Daily, February 12: The Greenback Slips in Subdued Activity

Swiss Franc The Euro has fallen by 0.08% to 1.064 EUR/CHF and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is...

Read More »FX Weekly Preview: Geopolitics Becomes More Salient as Monetary Policy Plays for Time

Say what one will, US President Trump is vigorously projecting what he believes are American interests. There is virtually no sign of the isolationism that many observers had anticipated. Indeed, as we have argued, the America First rejection of the League of Nations that Trump harkens back to was not isolationist as much as unilateralist. And the same is true of the Trump Administration. He is trying to get North Korea...

Read More »Currency intervention for Central Banks: When and at which level?

The papers from the Reserve Bank of New Zealand describes in easy words where central banks should intervene based on economic history and experience. It avoids the often used econometric considerations. For FX rates those often do not incorporate sufficient long-term data. Details1 Via Forexlive:It is very interesting, but what perhaps makes it more useful for a wider FX trader audience is its reference the triggers...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org