Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace. This is a messy and dynamic environment, in which the economy operates out of seeming randomness at times. Yet, here we have something that is “quantitatively” determined...

Read More »The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup? You can’t blame COVID at the tail end for a woeful string which actually dates back farther than the last pandemic (H1N1). Emil Kalinowski has it absolutely right; what happened in 2013 in the Treasury...

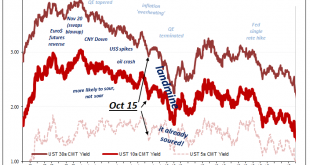

Read More »Bill Issuance Has Absolutely Surged, So Why *Haven’t* Yields, Reflation, And Other Good Things?

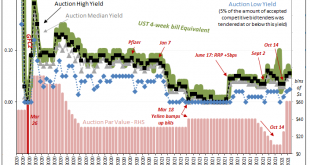

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though. Of the first, it’s been a real tsunami at this tenor, too. Up to early August, Treasury had regularly (weekly) sold $40 billion in one-month paper. From...

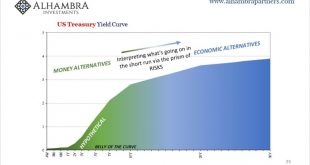

Read More »The Curve Is Missing Something Big

What would it look like if the Treasury market was forced into a cross between 2013 and 2018? I think it might be something like late 2021. Before getting to that, however, we have to get through the business of decoding the yield curve since Economics and the financial media have done such a thorough job of getting it entirely wrong (see: Greenspan below). And before we can even do that, some recent housekeeping at the front of the curve where bill lives. Treasury...

Read More »The Great Eurodollar Famine: The Pendulum of Money Creation Combined With Intermediation

It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.” While the “bank” did eventually fail, and the implications of it came to be systemic, those overly melodramatic descriptions actually served to downplay the event in public imagination. The world...

Read More »Tapering Or Calibrating, The Lady’s Not Inflating

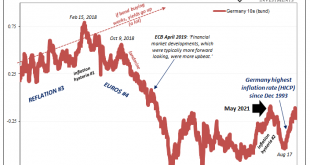

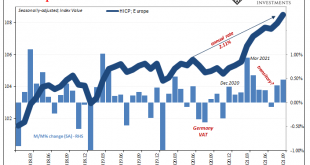

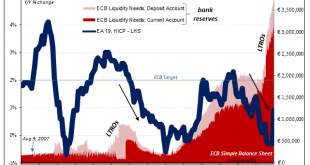

We’ve got one central bank over here in America which appears as if its members can’t wait to “taper”, bringing up both the topic and using that particular word as much as possible. Jay Powell’s Federal Reserve obviously intends to buoy confidence by projecting as much when it does cut back on the pace of its (irrelevant) QE6. On the other side of the Atlantic, Europe’s central bank will be technically be doing the same thing likely at the same time. Except,...

Read More »Taper *Without* Tantrum

Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary. Taper. Then the tantrum. Except, no, it wasn’t sulking rage over the prospects for fewer...

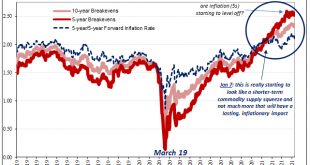

Read More »Rechecking On Bill And His Newfound Followers

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard). Even nearer-in inflation expectations have rounded off at their current top. Perhaps no more than a short-term rest before each rising again, then again with the rest of the...

Read More »The Endangered Inflationary Species: Gazelles

Nevada is, by all accounts and accountants, in rough shape. Very rough shape. An economy overly dependent upon a single industry, tourism, in this case, is a disaster waiting to happen should anything happen to that industry. Pandemic restrictions, for instance. Nevadans cannot afford the government spending they “have” without a gaming industry attracting visitors at full throttle. Desperate, the state’s governor Steve Sisolak announced last week that officials...

Read More »Even The People ‘Printing’ The ‘Money’ Aren’t Seeing It

Everyone in Europe has long forgotten about what was going on there before COVID. First, an economy that had been stuck two years within a deflationary downturn central bankers like Italy’s new recycled top guy Mario Draghi clumsily mistook for an inflationary takeoff. Both the inflation puzzle and ultimately a pre-pandemic recession have taken a back seat to everything corona. Whereas Draghi spent those years howling for inflationary conditions that were nowhere in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org