Fundamental Developments: Physical Gold Scarcity Increases Last week, the price of gold rose $25, and that of silver $0.60. Is it our turn? Is now when gold begins to go up? To outperform stocks? Something has changed in the supply and demand picture. Let’s look at that picture. But, first, here is the chart of the prices of gold and silver. Gold and Silver Price(see more posts on gold price, silver price, )Gold and...

Read More »The Big Picture: Paper Money vs. Gold

Numbers from Bizarro-World The past few months have been really challenging for anyone invested in gold or silver; for me personally as well. Despite serious warning signs in the economy, staggering debt levels and a multitude of significant geopolitical threats at play, the rally in risk assets seemed to continue unabated. In fact, I was struggling with this seeming paradox myself. As I kept looking at the state of...

Read More »The Interesting Seasonal Trends of Precious Metals

Precious Metals Patterns Prices in financial and commodity markets exhibit seasonal trends. We have for example shown you how stocks of pharmaceutical companies tend to rise in winter due to higher demand, or the end-of-year rally phenomenon (last issue), which can be observed almost every year. Gold, silver, platinum and palladium are subject to seasonal trends as well. Although gold and silver are generally perceived...

Read More »Is the Canary in the Gold Mine Coming to Life Again?

A Chirp from the Deep Level Mines Back in late 2015 and early 2016, we wrote about a leading indicator for gold stocks, namely the sub-sector of marginal – and hence highly leveraged to the gold price – South African gold stocks. Our example du jour at the time was Harmony Gold (HMY) (see “Marginal Producer Takes Off” and “The Canary in the Gold Mine” for the details). Mining engineer equipped with bio-sensor ...

Read More »You Can’t Eat Gold – Precious Metals Supply and Demand

You Actually Can Eat Gold, But Its Nutritional Value is Dubious “You can’t eat gold.” The enemies of gold often unleash this little zinger, as if it dismisses the idea of owning gold and indeed the whole gold standard. It is a fact, you cannot eat gold. However, it dismisses nothing. This gives us an idea. Let us tie three facts together. One, you can’t eat gold. Two, gold is in backwardation in Switzerland. And three,...

Read More »The Gold Standard: Protector of Individual Liberty and Economic Prosperity

A Piece of Paper Alone Cannot Secure Liberty The idea of a constitution and/or written legislation to secure individual rights so beloved by conservatives and among many libertarians has proven to be a myth. The US Constitution and all those that have been written and ratified in its wake throughout the world have done little to protect individual liberties or keep a check on State largesse. Sound money vs. a piece of...

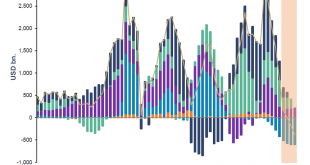

Read More »In Gold We Trust – Incrementum Chart Book 2018

The Most Comprehensive Collection of Charts Relevant to Gold is Here Our friends from Incrementum (a European asset management company) have just released the annual “In Gold We Trust” chart book, which collects a wealth of statistics and charts relevant to gold, with extensive annotations. Many of these charts cannot be found anywhere else. The chart book is an excellent reference work for anyone interested in the...

Read More »Yield Curve Compression – Precious Metals Supply and Demand

Hammering the Spread The price of gold fell nine bucks last week. However, the price of silver shot up 33 cents. Our central planners of credit (i.e., the Fed) raised short-term interest rates, and threatened to do it again in December. Meanwhile, the stock market continues to act as if investors do not understand the concepts of marginal debtor, zombie corporation, and net present value. People believe that the Fed...

Read More »Submerged Lighthouse Syndrome – Precious Metals Supply and Demand

Fundamental Developments – The Gap Keeps Widening Last week, the lighthouse went down 24 meters (gold went down $24), or 50 inches (if you prefer, silver went down 50 cents). However, let’s take a look at the only true picture of supply and demand. Are the fundamentals dropping with the market price? They done whacked our lighthouse! [PT] Image credit: Skip Willits - Click to enlarge Gold and Silver...

Read More »Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Fundamental Price has Deteriorated, but… Let us look at the only true picture of supply and demand in the gold and silver markets, i.e., the basis. After peaking at the end of April, our model of the fundamental price of gold came down to the level it reached last November. $1,300. Which is below the level it...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org