The Economist speculates that central bank independence might be on its way out. The article suggests that motives for independence (i.e., Sargent/Wallace or Barro/Gordon type arguments) might be less relevant given the environment of low inflation and interest rates. See also my earlier, related blog post.

Read More »When Is Death (Expected to Be) Better Than Life?

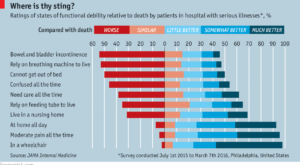

The Economist reports about research published in JAMA Internal Medicine summarizing the views of patients who suffer from various conditions about the quality of life.

Read More »Where the West is Still Alive

The Economist reports about the “American Redoubt” in the U.S. North West. Water, land, game, guns and bounty hunters.

Read More »India’s Tax System

In the FT, Amy Kuzmin reports that after debating for nearly a decade, India’s parliament has approved a long-awaited overhaul of the country’s fragmented tax system … The bill … will amend the constitution to permit replacing the current patchwork of national, state and local levies with a single, unified value added tax system. He expects the reform “to create a genuine single market” and hails it as “one of the most significant reforms to the Indian economy since liberalisation began...

Read More »Research Funding in Economics

In the Journal of Economic Perspectives, Tyler Cowen and Alex Tabarrok question whether NSF funds are allocated efficiently. They write: First, a key question is not whether NSF funding is justified relative to laissez-faire, but rather, what is the marginal value of NSF funding given already existing government and nongovernment support for economic research? Second, we consider whether NSF funding might more productively be shifted in various directions that remain within the legal and...

Read More »Scandinavian Fantasies?

In an NBER working paper entitled “The Scandinavian Fantasy: The Sources of Intergenerational Mobility in Denmark and the U.S.,” Rasmus Landersø and James J. Heckman argue that [m]easured by income mobility, Denmark is a more mobile society, but not when measured by educational mobility. … Greater Danish income mobility is largely a consequence of redistribution … policies. While Danish social policies for children produce more favorable cognitive test scores for disadvantaged children,...

Read More »Money Demand

In a recent NBER working paper, Luca Benati, Robert E. Lucas, Jr., Juan Pablo Nicolini, and Warren Weber report estimates of long-term money demand. They write: [U]sing annual data on money (M1, for us), nominal GDP, and short term interest rates from 31 countries over periods that range in some cases to over 100 years. We find remarkable stability in long run money demand behavior in many countries, and an equally surprising sameness across different countries. In some cases of...

Read More »Private Sector Rescue for Italian Bank

In the FT, Rachel Sanderson and Martin Arnold report that the board of Monte dei Paschi is about to approve a recapitalization led by JPMorgan in order to avoid the alternative, a bailin according to European rules. Other news sources reported that the European Commission had made it clear that it rejected the proposal by Italy’s prime minister (supported by the ECB president) to change the rules and let the Italian government finance the recapitalization. EU finance ministers and Angela...

Read More »“The IMF and the Crises in Greece, Ireland, and Portugal”

The Independent Evaluation Office of the International Monetary Fund released a critical report on IMF supported policies in Greece, Ireland and Portugal. It questions the legitimacy of certain decisions. The executive summary states that [t]he IMF’s pre-crisis surveillance mostly identified the right issues but did not foresee the magnitude of the risks … missed the build-up of banking system risks … shared the widely-held “Europe is different” mindset … Following the onset of the...

Read More »Inside Paradeplatz

On his blog, Lukas Hässig suggests that a leading Swiss banker might have exploited insider information. The comments to the post are even more revealing than the article.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org