Swiss Franc The Euro has risen by 0.38% to 1.1502 CHF. EUR/CHF and USD/CHF, February 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude...

Read More »FX Daily, December 11: Dollar Mixed to Start the Week, While Equities Firm

Swiss Franc The Euro has risen by 0.09% to 1.1691 CHF. EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed in relatively quiet activity. Year-end adjustment is well underway, and the news stream is light to start the week that sees more than a dozen central bank meetings. There is little doubt in the market...

Read More »Good things come to those who wait

Scandinavian currencies have lost ground lately against the euro, but a favourable economic and policy backdrop point to strengthening of the Swedish krona.Recent months have not been kind to Scandinavian currencies: the Swedish krona and the Norwegian krone lost, respectively, 4.3% and 4.7% against the euro from the start of September to 24 November.The weakness of the Swedish krona could be explained by some disappointment at the re-election of the very dovish Stefan Ingves as Riksbank...

Read More »FX Daily, September 21: Market Digests Fed, Greenback Consolidates, Antipodeans Tumble

Swiss Franc The Euro has risen by 0.17% to 1.1477 CHF. EUR/CHF and USD/CHF, September 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The market has mostly interpreted the Fed’s action in line with our thinking. Despite the lowering of the long-run Fed funds rate, the shifting one of the three hikes from 2019 into 2020, and recognizing that the weaker price impulses...

Read More »FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

(The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe) Several developments have attracted our attention, but the key take away is that the global capital markets have stabilized after appearing downright frightful at the end of last week, as stocks, yields, and the dollar plummeted. Equities rallied om Monday and there was follow through buying in...

Read More »FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

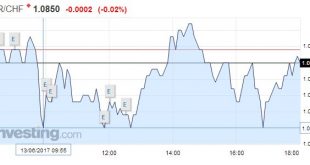

Swiss Franc The Euro has fallen by 0.02% to 1.0850 CHF. EUR/CHF - Euro Swiss Franc, June 13(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of...

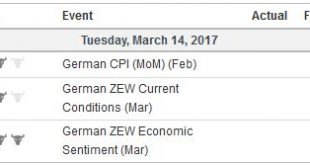

Read More »FX Weekly Preview: Succinct Views of Ten Events and Market Drivers: Week Ahead

The week ahead is the busiest week of the first quarter. It sees four major central meetings, including the Federal Reserve which is likely to raise rates for the second time in four months. The Dutch hold the first European election of the year, and the populist-nationalist party remains in contention for the top slot. The week concludes with the G20 meeting, the first that the Trump Administration’s presence will be...

Read More »FX Daily, December 15: Greenback Extends Gains on Back of Fed

Swiss Franc EUR/CHF - Euro Swiss Franc, December 15(see more posts on EUR/CHF, ) - Click to enlarge Sterling has made steady gains against the CHF over the past month and although the spike has levelled this week, the Pound has certainly gained a foothold. Yesterday’s decision by the US Federal Reserve to raise their base rate from 0.25% to 0.5% did little to shift the value of GBP/CHF but with investors...

Read More »Riksbank and Norges Bank Policy Meetings

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Six major central banks meeting over the next six sessions. Sweden’s Riksbank is the most likely ease policy of these central banks, but it is not particularly likely. Norway is decisively on hold, as fiscal policy does some of the heavy lifting....

Read More »Is Oil about to Rollover?

Summary: Oil has rallied 20% since mid-September. Market may be getting ahead of itself. US rig count has risen by more than 100 in less than 4-months and inventories, seasonally adjusted are at record highs. The price of oil has risen more than 20% over the past month. It is being driven by ideas that OPEC (and Russia) may implement a freeze or an output cut at the end of next month. At the same time, US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org