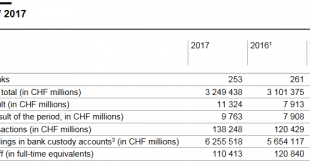

Summary of the 2017 banking year Of the 253 banks in Switzerland, 229 recorded a profit in 2017, posting a total profit of CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period for all banks was CHF 9.8 billion. The aggregate balance sheet total rose by 4.8% to CHF 3,249.4 billion. On the assets side, domestic mortgage loans continued to advance, by...

Read More »FX Daily, June 28: US Dollar Remains Firm, Sends Yuan, Rupee, Sterling and Kiwi to New 2018 Lows

Swiss Franc The Euro has risen by 0.24% to 1.1545 CHF. EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating its gains against most of the major currencies, but the underlying strength remains evident. Several major and emerging market currencies are at new lows for the year, including sterling and the New Zealand...

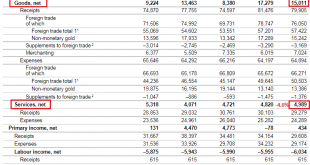

Read More »Swiss Balance of Payments and International Investment Position: Q1 2018

Current Account The current account surplus amounted to CHF 18 billion, a CHF 5 billion increase over the year-back quarter. It was calculated as the sum of all receipts (CHF 149 billion) minus the sum of all expenses (CHF 131 billion). Key figures: Current Account: Up 41% against Q1/2017 to 18.1 bn. CHF of which Goods Trade Balance: Up 62.7% against Q1/2017 to 15.1 bn. of which the Services Balance: Minus 6.2% to...

Read More »‘Cryptocurrencies too primitive for national money’: SNB director

Cryptocurrencies, such as bitcoin, have been criticised by the Bank for International Settlements for having a series of perceived technical flaws (Keystone) Cryptocurrencies and the blockchain technology they run on are currently far too primitive for the Swiss central bank to consider issuing a digital franc, says board director Thomas Moser. Moser’s comments on Thursday reflected the previously stated stance taken by...

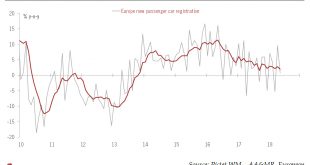

Read More »European cars at a crossroad

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry. The motor vehicle industry is of major importance to the EU economy and to global trade. According to Eurostat, total exports (to countries outside the EU) amounted to EUR205bn in 2017. Germany accounted for 52% of total motor exports. The US was the largest destination for EU motor...

Read More »Swiss Offshore Wealth Management Sector still World’s Largest by far

A report by The Boston Consulting Group highlights the size of Switzerland’s personal offshore wealth management sector. ©-Valeriya-Potapova-_-Dreamstime.com_ - Click to enlarge Total personal offshore wealth grew by 6% to reach US$8.2 trillion in 2017. US$2.3 trillion (28%) of this was managed in Switzerland. The top three offshore centres: Switzerland ($2.3 trillion), Hong Kong ($1.1 trillion) and Singapore ($0.9...

Read More »FX Daily, June 18: Politics and Economics Weigh on European Currencies

Swiss Franc The Euro has fallen by 0.40% to 1.1533 CHF. EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against most of the major and emerging market currencies. The prospects of escalating trade tensions and the divergence of policy that was confirmed by the major central banks are disrupting the markets. Norway’s...

Read More »Union européenne. Les chiffres de la dette. LHK

L’histoire de la construction de l’Union européenne est avant tout une histoire d’endettement public. La preuve en un graphique: Le volume cumulée d’endettement de l’UE atteint en 2017 le chiffre respectable de 12, 46664 billions d’euros (à ne pas confondre avec le billion américain!). Cela revient à un endettement cumulé de 12 466 640 000 000 euros, soit 12 trillions d’euros (référence de mesure US) Maintenant, la...

Read More »Switzerland remains biggest offshore wealth centre

Switzerland still attracts a lot of wealth The stock market boom boosted personal financial wealth around the globe by 12% last year – to the benefit of Switzerland. It is still the world’s biggest centre for managing offshore wealth at $2.3 trillion (CHF2.3 trillion). Figures revealed in a Boston Consulting Group reportexternal link published on Thursday put the country ahead of Hong Kong ($1.1 trillion) and Singapore...

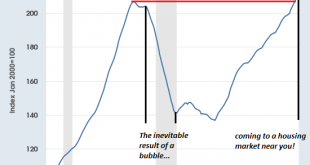

Read More »Here We Go Again: Our Double-Bubble Economy

The bubbles in assets are supported by the invisible bubble in greed, euphoria and credulity. Well, folks, here we go again: we have a double-bubble economy in housing and stocks, and a third difficult-to-chart bubble in greed, euphoria and credulity. Feast your eyes on Housing Bubble #2, a.k.a. the Echo Bubble: S&P/Case-Shiller 2000-2018 - Click to enlarge Here’s the S&P 500 stock index (SPX): no bubble...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org