Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Thomas Jordan - Click to enlarge Introductory remarks by Thomas Jordan Ladies and gentlemen It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will...

Read More »Andréa M. Maechler: Introductory remarks, news conference

Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Complete text: PDF (478 KB) I will begin my remarks with a review of the situation on the financial markets, before going on to discuss the progress made in reference interest rate reform. Situation on the financial markets Let me start with developments on the financial markets....

Read More »News conference Swiss National Bank 2017, Fritz Zurbrügg

Fritz Zurbrügg, Vice Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Fritz Zurbrugg - Click to enlarge Introductory remarks by Fritz Zurbrügg In my remarks today, I would like to address some of the developments currently taking place in the field of financial stability. I shall look at the big banks first before turning to the domestically...

Read More »SNB Monetary policy assessment of 14 December 2017

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign...

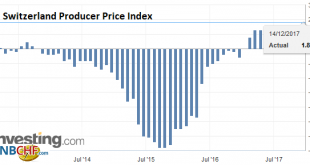

Read More »Swiss Producer and Import Price Index in November 2017: +1.8 YoY, +0.6 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »The Swiss economy is gaining momentum

Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0%, its lowest level since 2012. However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth. Switzerland’s...

Read More »FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

Swiss Franc The Euro has risen by 0.18% to 1.1673 CHF. EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment...

Read More »FX Daily, December 12: UK Front and Center, but Sterling is Laggard in Today’s Move Against the Dollar

Swiss Franc The Euro has fallen by 0.15% to 1.1651 CHF. EUR/CHF and USD/CHF, December 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden’s inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining...

Read More »49 Countries Have Violated Sanctions On North Korea

A new report from the Institute for Science and International Security has found that 49 countries violated sanctions on North Korea to varying degrees between March 2014 and September 2017. You will find more statistics at Statista 13 governments including Cuba, Egypt, Iran and Syria were involved in military violations, which as Statista’s Martin Armstrong notes, includes either receiving military training from North...

Read More »Russia, China and BRICS: A New Gold Trading Network

One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia. In...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org