But investors should keep in mind that yields on government bonds could easily spike Global bond yields have plunged to new lows in recent days, as markets have switched to ‘risk off’ mode. This is just the latest manifestation of a trend: sovereign bond yields have been under downwards pressure for several years. Central bank QE and economic uncertainty are partly to blame. But investors should remember that sovereign bonds are not risk-free assets. And yields could easily jump over the...

Read More »Interest Rates: How Low Can They Go?

When Denmark introduced negative interest rates in 2012, it was a pioneer. But the policy has become such an accepted part of central banks’ toolbox in the years since that financial pundits hardly batted an eyelash when Hungary became the world’s sixth central bank to introduce negative rates in March 2016. As the practice becomes more widespread, the question of how low interest rates can go has become increasingly relevant for investors. While every country (or region, in the case...

Read More »VIDEO: Are Negative Rates All There Is?

Are negative interest rates merely a sign that central bankers have run out of ideas? Could the policy eventually make its way to the United States? Watch Jonathan Wilmot, Credit Suisse’s Head of Macro Investments, Asset Management, discuss what negative rates indicate about global monetary policy.

Read More »INTERACTIVE: How Do Negative Interest Rates Work?

Negative Rates: Explaining the BoJ’s reticence

You’ll have noticed that the yen and Nikkei were displeased yesterday. Like throw your toys out of the pram because you didn’t get what you wanted displeased. Like one of the worst one day JPY moves in the past decade displeased. What they didn’t get, and what prompted that tantrum, was any auld bit of easing from the Bank of Japan. And here are eight potential reasons why the BoJ disappointed, from SocGen: 1) there is a risk that the market may once again perceive limits to the...

Read More »The dark side of negative interest rates

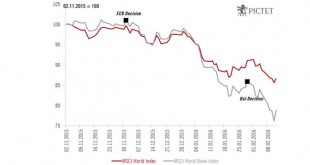

Recent equity market peaks coincided with the ECB and BoJ decisions to impose negative rates. From December 1st to last Friday, the MSCI World index declined by 14%. During the same period, the MSCI world banks index declined by 24%. Recent chronology of events Since 2009 and up until recently, central bank action has helped to stabilise equity markets. Looking at recent events, it now seems that the opposite is becoming true. The last two monetary decisions (ECB on 3 December 2015 and BoJ...

Read More »Are Central Banks Running Out of Steam?

In the old days, before the world was awash in capital with nowhere to go, an announcement of monetary easing was generally considered a good thing, a sign that central bankers were on the job. Historically, in all but the most extreme circumstances, lower interest rates have tended to spur economic activity, with the contemporaneous effect of supporting risky assets. But we are clearly living in an extreme circumstance, and after eight years of such announcements from central banks, it’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org