Swiss Franc The Euro has risen by 0.17% to 1.164 CHF. EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a little wobble, sterling has responded favorably to the resignation of the UK Brexit team led by David Davis. The idea is that a path to a softer Brexit is good for sterling. In fairness, it is a bit early to reach this conclusion, and...

Read More »FX Daily, July 02: Third Quarter Begins With a Thump

The window dressing ahead of the end of Q2 failed to signal a turn in sentiment. Equity markets have taken back those gains and more. The US dollar is broadly firmer, though it was coming off its best levels near midday in Europe, and the three-basis-point slippage puts the US 10-year yield at 2.83%, its lowest in more than a month. Investors are wrestling with the implications of escalating trade tensions. The US...

Read More »FX Weekly Preview: Macro Matters Now, Just Not the Data

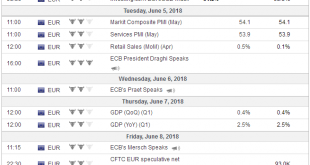

The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new...

Read More »FX Daily, May 25: US Dollar Loses Momentum Ahead of the Weekend

Swiss Franc The Euro is down by 0.63% to 1.1545 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Italian stocks are flat, while most European bourses are higher, with the Dow Jones Stoxx 600 up 0.5% in late morning turnover in Europe. The benchmark is lead by real estate,...

Read More »FX Daily, May 17: US Rates Edge Higher, while Dollar Turns Mixed

Swiss Franc The Euro has risen by 0.02% to 1.1821 CHF. GBP and CHF The Pound has remained fairly range bound against the Swiss Franc during the last couple of weeks as the markets appear to adopting a wait and see approach as to what might happen in the medium to long term. The Pound fell marginally during this time after the Bank of England once again decided to keep interest rates on hold at a split of 7-2 in...

Read More »FX Weekly Preview: Fed Can Look Through the Data Easier than the ECB and BOJ

Geopolitical issues will continue to bubble below the surface for the capital markets. The fallout from the reimposition of US sanctions on Iran has apparently helped lift oil prices in the face of the rising dollar, which often acts as a drag. In the coming days, the US will take the symbolic step of moving its embassy to Jerusalem. The conflict between Israel and Iranian forces in Syria is escalating. Meanwhile, US...

Read More »FX Daily, May 11: Dollar Momentum Sapped, Near-Term Pullback Likely

Swiss Franc The Euro has fallen by 0.11% to 1.1937 CHF. EUR/CHF and USD/CHF, May 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar pulled back following yesterday’s slightly softer than expected CPI report and this likely marks the beginning of a new phase, with the dollar moving lower. Investors have learned over the past two weeks that neither wages nor...

Read More »FX Weekly Preview: Geopolitics Becomes More Salient as Monetary Policy Plays for Time

Say what one will, US President Trump is vigorously projecting what he believes are American interests. There is virtually no sign of the isolationism that many observers had anticipated. Indeed, as we have argued, the America First rejection of the League of Nations that Trump harkens back to was not isolationist as much as unilateralist. And the same is true of the Trump Administration. He is trying to get North Korea...

Read More »Great Graphic: Is the Canadian Dollar a Buy Soon against the Mexican Peso?

Summary: The Canadian dollar has fallen ~7.5% against the Mexican peso this year. Mexico has much greater political risk than Canada. Be patient. Look for a reversal pattern nearer key support. This Great Graphic composed on Bloomberg shows the Canadian dollar against the Mexican peso since the start of last year. There have been three big moves. The Canadian dollar trended lower against the peso as it corrected from...

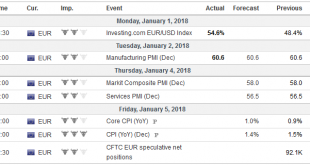

Read More »The Past is Not Passed: 2017 Spills into 2018

The New Year may have begun in fact, but in practice, full participation may return only after the release of US employment data on January 5. The macroeconomic and policy tables have been set, though interpolating from the Overnight Index Swaps market, there is 45% chance the Bank of Canada hikes rates at its policy meeting near the middle of the month. In the currency markets, sentiment appears to be as uniformly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org