What was the difference between Bear Stearns and Lehman Brothers? Well, for one thing Lehman’s failure wasn’t a singular event. In the heady days of September 2008, authorities working for any number of initialism agencies were busy trying to put out fires seemingly everywhere. Lehman had to compete with an AIG as well as a Wachovia, already preceded by a Fannie and a Freddie. If Lehman was the personification of...

Read More »Just In Time For The Circus

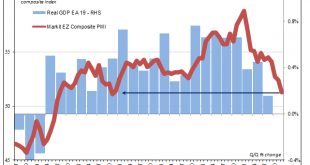

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up the more “they” say it’s nothing just transitory roughness. Globally...

Read More »Xi Jinping’s Pretty Consistent Message

It seems many were disappointed by the speech delivered by Xi Jinping. China’s supreme leader spoke at the Great Hall of the People in Beijing today on the 40th anniversary of his country’s first embrace of economic reform. Commentators had been expecting Xi to use the occasion to recommit to liberalization, further opening China to free market forces. Some others, as we’ve noted, were hoping China’s President would go...

Read More »Powell: Still Strong; Markets: AYFKM

The official statement that accompanies each every FOMC policy action is by nature bland and sterile. Still, despite the sparseness of printed words those that are included can say a lot. Here’s its essence for what just wrapped up in December 2018: The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity,...

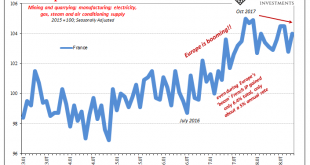

Read More »Industrial Fading

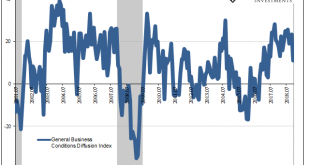

It is time to start paying attention to PMI’s again, some of them. There are those like the ISM’s Manufacturing Index which remains off in a world of its own. The version of the goods economy suggested by this one index is very different than almost every other. It skyrocketed in late summer last year way out of line (highest in more than a decade) with any other economic account. For that reason alone, it has been...

Read More »The Relevant Word Is ‘Decline’

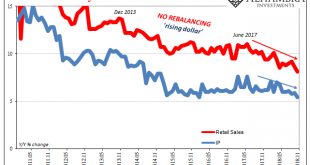

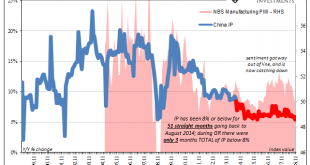

The English language headline for China’s National Bureau of Statistics’ press release on November 2018’s Big 3 was, National Economy Maintained Stable and Sound Momentum of Development in November. For those who, as noted yesterday, are wishing China’s economy bad news so as to lead to the supposed good news of a coordinated “stimulus” response this was itself a bad news/good news situation. If the Communist State...

Read More »Sometimes Bad News Is Just Right

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019). We won’t know the full details...

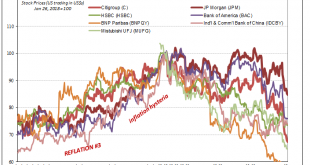

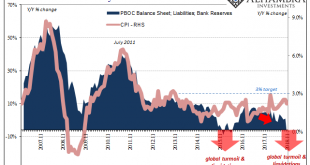

Read More »US Banks Haven’t Behaved Like This Since 2009

If there is one thing Ben Bernanke got right, it was this. In 2009 during the worst of the worst monetary crisis in four generations, the Federal Reserve’s Chairman was asked in front of Congress if we all should be worried about zombies. Senator Bob Corker wasn’t talking about the literal undead, rather a scenario much like Japan where the financial system entered a period of sustained agony – leading to the same in...

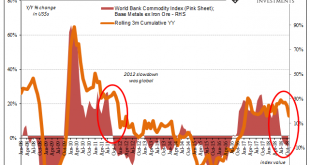

Read More »China Going Back To 2011

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of...

Read More »‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts. Italy has found competition in the race to violate EU fiscal guidelines. Around the rest of Europe, the question is being asked....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org