Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month. Subsequent months of data had continued the trend. By November, the PMI registered 52.6...

Read More »Latest European Sentiment Echoes Draghi’s Last Take On Global Economic Risks

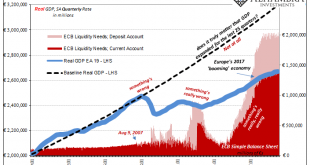

While sentiment has been at best mixed about the direction of the US economy the past few months, the European economy cannot even manage that much. Its most vocal proponent couldn’t come up with much good to say about it – while he was on his way out the door. At his final press conference as ECB President on October 24, Mario Draghi had to acknowledge (sort of) how he is leaving quite the mess for Christine Lagarde. Incoming data since the meeting in September...

Read More »All Signs Of More Slack

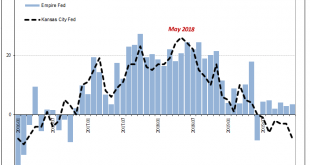

The evidence continues to pile up for increasing slack in the US economy. While that doesn’t necessarily mean there is a recession looming, it sure doesn’t help in that regard. Besides, more slack after ten years of it is the real story. The Federal Reserve’s favorite inflation measure in October 2019 stood at 1.31%, matching February for the lowest in several years. Despite constantly referencing a tight labor market and its fabulous unemployment rate, broad...

Read More »Still Stuck In Between

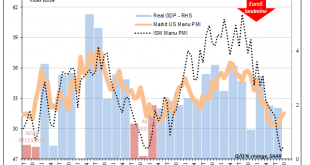

Note: originally published Friday, Nov 1 There wasn’t much by way of the ISM’s Manufacturing PMI to allay fears of recession. Much like the payroll numbers, an uncolored analysis of them, anyway, there was far more bad than good. For the month of October 2019, the index rose slightly from September’s decade low. At 48.3, it was up just half a point last month from the month prior. Most of that was related to a curious surge in New Export Orders. Having dropped to...

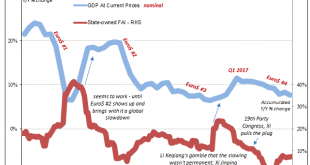

Read More »More Synchronized, More Downturn, Still Global

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus. China GDP, 2007-2019(see more posts on China Gross Domestic Product, )...

Read More »Somehow Still Decent European Descent

How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year. From last August: In spite of...

Read More »More Down In The Downturn

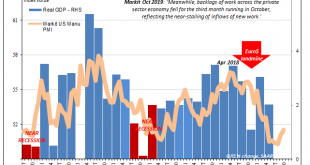

Flash PMI’s from IHS Markit for the US economy were split in October. According to the various sentiment indicators, there’s a little bit of a rebound on the manufacturing side as contrary to the ISM’s estimates for the same sector. Markit reports a sharp uptick in current manufacturing business volumes during this month. The manufacturing index came in at 51.5, up from a revised reading of 51.1 in September based almost entirely on the production subset. But at the...

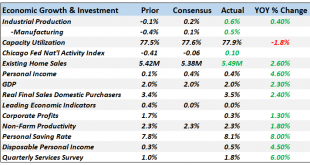

Read More »Monthly Macro Monitor: Doom & Gloom, Good Grief

When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time. That has proven to be valuable advice over the years and I think still relevant today. We continue to hear, on an...

Read More »No Longer Hanging In, Europe May Have (Been) Broken Down

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their “accommodations.” It’s only a little...

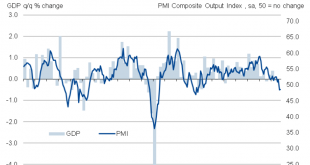

Read More »Focus Is On The Pre-recession Condition

Before the Great “Recession” ended the business cycle as we once knew it, there was a widely accepted concept known as stall speed. In the US, if GDP growth decelerated down to around 2% it suggested the system had reached a danger zone of sorts. In a such a weakened state, one good push, or shock, could send the economy plunging into recession. Any economy which might slow down into a weakened state for whatever reasons becomes susceptible. What might be a minor,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org