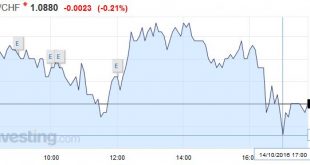

Swiss Franc EUR/CHF - Euro Swiss Franc, October 17 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is consolidating in relatively narrow trading ranges. Participants appear to be waiting for fresh incentives, while the recent rise yields continue and equities have begun the new week on a soft note. Yellen spoke before the weekend, and her explicit willingness to tolerate higher...

Read More »FX Daily Rates, October 17: Dollar Starts Week Narrowly Mixed, while Bonds and Stocks Retreat

Swiss Franc EUR/CHF - Euro Swiss Franc, October 17 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is consolidating in relatively narrow trading ranges. Participants appear to be waiting for fresh incentives, while the recent rise yields continue and equities have begun the new week on a soft note. Yellen spoke before the weekend, and her explicit willingness to tolerate higher...

Read More »Weekly Speculative Positions: More Bearish Euros and CHF, Less Bullish the Yen

With the strong ISM non-manufacturing PMI last week, long positions on the dollar are increasing, while speculators increase their euro and Swiss Franc shorts. CHF net shorts increased to 9.4 K positions. That the euro has depreciated against CHF, is possibly caused by real, non-speculative money into CHF, i.e. money in the form of cash and stock purchases. We will get more information tomorrow when the SNB sight...

Read More »FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

Swiss Franc EUR/CHF - Euro Swiss Franc, October 14 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm against most of the major currencies, but within yesterday’s ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the...

Read More »FX Daily, October 13: Dollar Edges Higher, though US Rates Soften

Swiss Franc The EUR/CHF remains in the range of 1.0815 to 1.0980. The SNB usually intervenes below 1.0850. I am expecting that speculators are reducing their CHF short positions. More tomorrow. EUR/CHF - Euro Swiss Franc, October 13 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm, and the euro has slipped below $1.10 for the first time since late-July. Although the dollar’s...

Read More »IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

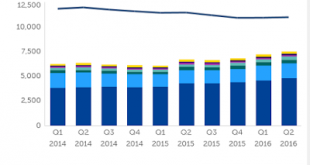

Summary: The increase in the yen’s share of reserves was flattered by the yen’s 9% appreciation. The dollar and euro’s share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan’s share of reserves. The IMF provides the most authoritative data on central bank reserves. The composition is...

Read More »FX Daily, October 11: The Dollar Remains Bid

Swiss Franc EUR CHF - Euro Swiss Franc, October 11 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger...

Read More »FX Daily, October 10: Dollar after the Second Debate

Swiss Franc EUR/CHF - Euro Swiss Franc, October 10 2016(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar has started the new week on a firm note. The light news stream and holidays in Japan, Canada and the United States make for a subdued session. Notable exceptions to the dollar’s gains are the Canadian dollar and Mexican peso. Both currencies appear to have been. underpinned by US...

Read More »FX Weekly Preview: The Week Ahead: It’s Not about the Data

High frequency economic reports will be not be among the key drivers of the capital markets in the week ahead. The light schedule, consisting mostly of industrial production in Europe, inflation for Scandinavia, and US retail sales, will have minimal impact on rate expectations. A November rate Fed move was never very likely. The September employment report needed to be amazingly strong to boost the chances, and it was...

Read More »FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Swiss Franc EUR/CHF - Euro Swiss Franc, October 07 2016. - Click to enlarge FX Rates Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480. Over the last couple of years,there have been a number of sudden dramatic moves...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org