Overview: The month-end and slew of data is making for a volatile foreign exchange session, while the rash of earnings has generally been seen as favorable though weakness was seen among the semiconductor chip fabricators. China, Hong Kong, and Japanese equities fell but the other large markets in the region rose. Europe’s Stoxx 600 is up around 0.8%. It is the eighth advance in the past 10 sessions. US futures are higher and the S&P 500’s advance of nearly 7.6%...

Read More »What Happened Today in a Few Bullet Points

The most important thing to appreciate is that the market has moved to price not one but two cuts next year. The first is priced into the September Fed funds futures and the second is in the Dec Fed funds futures. This I in response to weaker than expected data that have elevated recession fears. The Atlanta Fed GDPNow puts Q2 growth at -2.1%. Banks have revised down their forecasts, but none of the 59 economists in the Bloomberg survey have forecast a negative...

Read More »Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

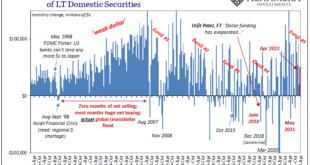

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system. This much was apparent right from the start, with financial markets gone haywire three months ago (mid-March seasonal bottleneck), and then more of the same into April right to now. The updated TIC data for the month of...

Read More »Expect the Unexpected from the Fed

It has been a rough week in most markets with both equities and bonds declining sharply. Tech stocks have been pummeled with many ‘big names’ plunging more than 50% (from their 52-week high). Some of the bigger names include Zoom Video -75%, PayPal -73%, Netflix -72%, Meta Platforms (Facebook), -53%. . The equity market decline is coupled with announced layoffs. Robinhood, the popular online trading platform, announced a 9% reduction in full-time staff this week for...

Read More »Yen Blues

Overview: Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates are mostly 5-8 bp higher. The 10-year UK Gilt yield is up nine basis points to push near 1.98%. The higher yields are seeing the yen’s losing streak extend, and the greenback has jumped 1% to around JPY128.45 The dollar is trading lower against the other major currencies but the Swiss franc. The dollar-bloc currencies...

Read More »Greenback Starts New Week on Firm Note

Overview: With many financial centers, especially in Europe, closed for the long holiday weekend, risk-appetites remain in check. Most Asia Pacific markets fell, and poor earnings from Infosys and Tata Consultancy, saw India pace the decline with a 2% drop. US futures are also trading with a heavier bias. Interest rates remain firm. The US 2- and 10-year yields are up a couple of basis points to 2.47% and 2.85% respectively. China’s GDP inexplicable rose though...

Read More »US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools. The war has pushed up the price of energy, metals, and foodstuffs, which seemed to be advancing prior to the conflict. High-frequency economic data are important because of the insight generated about...

Read More »FX Daily, March 11: Risk Extends Gains Ahead of the ECB

Swiss Franc The Euro has fallen by 0.18% to 1.1065 EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Even though the NASDAQ closed lower yesterday and the reception of the 10-year Treasury auction did not excite, market participants are growing more confident. Led by China, the major markets in the Asia Pacific region rallied. The Shanghai Composite’s 2.35% gain not only snaps a...

Read More »FX Daily, December 8: Consolidative Moment as Markets Wait for Fresh Developments

Swiss Franc The Euro has fallen by 0.08% to 1.0771 EUR/CHF and USD/CHF, December 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Three brinkmanship dramas continue to play out. The UK-EU trade talks have reportedly made little progress and may have even moved backward, according to some reports, over the past two days. The EU and Poland, and Hungary will be butting heads at the leaders’ summit that begins...

Read More »FX Daily, December 7: Holy Mackerel Will UK-EU Talks Really Flounder?

Swiss Franc The Euro has fallen by 0.21% to 1.0794 EUR/CHF and USD/CHF, December 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimists see the belabored talk between the UK and EU as providing for a dramatic climax of a deal, while the pessimists warn that the divergence is real. Sterling opened three-quarters of a cent lower in early turnover and is now off around two cents. This, coupled with new US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org