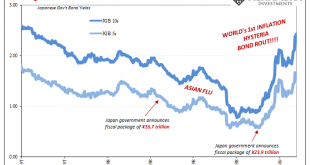

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months. The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar...

Read More »FX Daily, January 08: Can the Dollar Find Traction Even if the Employment Data Disappoint?

Swiss Franc The Euro has fallen by 0.32% to 1.0825 EUR/CHF and USD/CHF, January 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global equity rally picked up this week as it closed in 2019. The MSCI Asia Pacific Index gained today and is up in nine of the past 10 sessions. It has fallen only in one week since the end of October. South Korea’s Kospi led today’s advance with a nearly 4% rally on the back...

Read More »Meanwhile, Outside Today’s DC

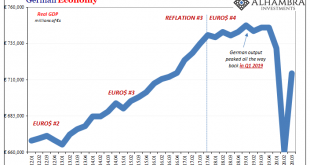

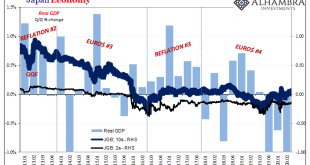

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage. Either way, Europe gets at it first. In 2018, what had been...

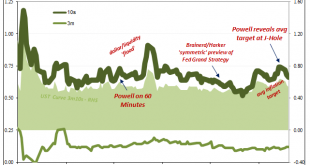

Read More »Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground. And so it was also in the bond market....

Read More »Monthly Macro Monitor – September 2020

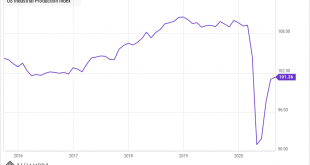

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end. 2nd quarter was a giant downdraft and 3rd quarter saw an initial rapid climb out the giant hole dug by the shutdowns (an own goal of epic...

Read More »Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates? Not for nothing, every couple years when we do those (record low yields) that’s what “they” always say and yet...

Read More »Powell Would Ask For His Money Back, If The Fed Did Money

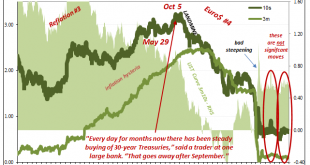

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!! Each has been characterized as the handywork of master monetary tactician Jay Powell. There is some truth underlying, only stripped of all that hyperbole. These backups in...

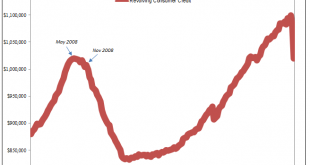

Read More »A Second Against Consumer Credit And Interest ‘Stimulus’

Credit card use entails a degree of risk appreciated at the most basic level. Americans had certainly become more comfortable with debt in all its forms over the many decades since the Great Depression, but the regular employment of revolving credit was perhaps the apex of this transformation. Does any commercial package on TV today not include one or more credit card offers? It certainly remains a staple of junk mail. Leaning more and more on credit cards during the...

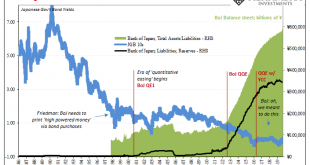

Read More »From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and then no recovery....

Read More »Open Letter to Crispin Odey

Crispin Odey I am writing in response to the comments you made in a letter to investors yesterday, which were widely reported. You have set the gold community afire, with claims that are not new and not true. So I shall attempt to douse the flames. As everyone knows, President Roosevelt outlawed the ownership of gold in 1933. Although gold was legalized in 1975, fears linger today that the governments may repeat this heinous act. There is no reason for this fear. In...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org