Global demand for gold is increasing while new discoveries of gold remain small Gold mining output in Australia is forecast to decrease by 50% in the next eight years Decline in global gold mining supply makes a price increase almost certain The demand for gold is increasing, yet new discoveries of the precious metal have not kept pace with the demand. Funds for exploration are historically high, $54.3 billion, up 60...

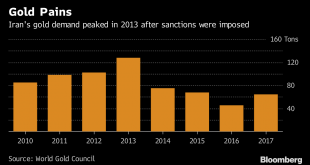

Read More »Iran’s Gold Demand May Surge On Trump Sanctions

Iran’s gold demand will probably be “strong” for the next few months and then gradually decline as U.S. sanctions start to take effect, according to the researcher who covers the country for Metals Focus Ltd. After a previous set of sanctions was imposed on Iran in 2012, it took two years for the country’s gold demand to start falling, according to data from the World Gold Council. It sank to only 45.1 tons by 2016, the...

Read More »Own Some Gold and Avoid Overvalued Assets

We could be heading for a golden age – or a return to the 1970s The cost to the US government of borrowing money for a decade came within sniffing distance of 3% yesterday. The US ten-year Treasury yield is sitting at 2.96% as I write this morning, having got to 2.99% yesterday. Does this really matter? After all, 3% is just another number. On the one hand, you’d be right to think that. On the other, it’s not so much...

Read More »“Blood In The Streets” Of U.S. Gold Bullion Coin Market

U.S. Mint American Eagle gold coin sales collapse to weakest April since 2007 giving contrarian value buyers another buy signal Sales of U.S. Mint American Eagle gold coins dropped to their weakest April since 2007, while silver coin purchases for the month rose 10 percent higher than last year, U.S. government data showed on Monday. The U.S. Mint sold 4,500 ounces of American Eagle gold coins in April, down 25...

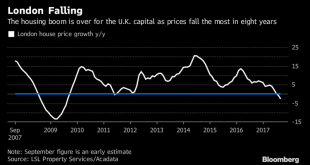

Read More »London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– London house prices fell by 3.2% in the first quarter – Halifax – Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or...

Read More »New All Time Record Highs For Gold In 2019

– New all time record highs for gold in 2019– ‘Powerful bull market’ will likely send gold to $5,000 to $10,000– If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’– Traditional portfolio of stocks and bonds will not protect investors– “Gold will replace bonds as the go-to hedge” by Brian Delaney of Secure Investments Gold is gaining momentum after a 5-year consolidation and is set to...

Read More »Palladium Bullion Surges 17% In 9 Days On Russian Supply Concerns

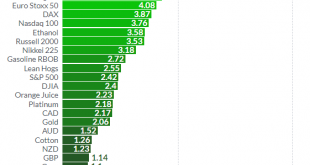

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in...

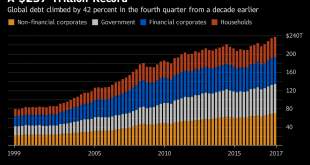

Read More »Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

– Global debt bubble hits new all time high – over $237 trillion– Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD – Increase in debt equivalent to United States’ ballooning national debt – Global debt up $50 trillion in decade & over 327% of global GDP – $750 trillion of bank derivatives means global debt over $1 quadrillion – Gold will be ‘store of value’ in coming economic...

Read More »Volatile Week Sees Oil and Palladium Surge Over 8%, Gold and Silver Marginally Higher and Stocks Gain

– Gold & silver eke out small gains; palladium surges 8% and platinum 2% – Oil (WTI) surges over 8% to over $66.90/bbl; supply disruption risk – U.S. dollar and Treasuries fall; geopolitical, trade war and fiscal concerns– Stocks rally and shrug off trade war, macro and geo-political risks – Bitcoin, major cryptos (Ethereum, Ripple etc) rise sharply– Russia-US tensions high: Trump warns attack ‘could be very soon or...

Read More »EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East – Middle East war involving Russia may badly impact energy dependent & fragile EU – Trade and actual wars on European doorstep show the strategic weakness of the EU– Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations– Investors should diversify to hedge investment, currency...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org