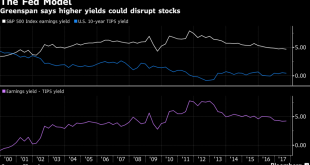

Former Fed Chairman warns of bond bubble, stagflation “Moving into a … stagflation not seen since the 1970s” This will not be “good for asset prices” 10 Yr Gov bond yields fell from 15.8% in 1981 to 2.3% Interest rates will not stay low, will rise ‘reasonably fast’ “Normal” interest rates in 4%-5% range Inflation will not stay at historically low levels Gold “protects savings” and is “store of value” Gold is the...

Read More »Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

Former Fed Chairman warns of bond bubble, stagflation “Moving into a … stagflation not seen since the 1970s” This will not be “good for asset prices” 10 Yr Gov bond yields fell from 15.8% in 1981 to 2.3% Interest rates will not stay low, will rise ‘reasonably fast’ “Normal” interest rates in 4%-5% range Inflation will not stay at historically low levels Gold “protects savings” and is “store of value” Gold is the...

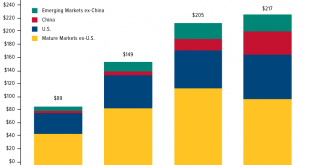

Read More »Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

‘Mother of all debt bubbles’ keeps gold in focus Global debt alert: At all time high of astronomical $217 T India imports “phenomenal” 525 tons in first half of 2017 Record investment demand – ETPs record $245B in H1, 17 Investors, savers should diversify into “safe haven” gold Gold good ‘store of value’ in coming economic contraction Gold’s medium- to long-term investment case, I believe, looks even brighter. Many...

Read More »Why Surging UK Household Debt Will Cause The Next Crisis

Easy credit offered by UK banks is endangering “everyone else in the economy” UK banks are “dicing with the spiral of complacency” again Bank of England official believes household debt is good in moderation Household debt now equals 135% of household income Now costs half of average income to raise a child Real incomes not keeping up with real inflation 41% of those in debt are in full-time work £1.537 trillion owed...

Read More »Gold Seasonal Sweet Spot – August and September – Coming

– Gold seasonal sweet spot – August and September – is coming– Gold’s performance by month from 1979 to 2016 – must see table– August sees average return of 1.4% and September of 2.5%– September is best month to own gold, followed by January, November & August Looking back at gold’s performance since 1979, August and September are big months for the yellow metal. What is the cause? No one really knows but there are...

Read More »Gold Hedge Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

– Gold hedge against currency devaluation – cost of fuel, food, housing – True inflation figures reflect impact on household spending– Household items climbed by average 964%– Pint of beer sees biggest increase in basket of goods – rise of 2464%– Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%– Gold rises 2672% and hold’s its value over 40 years– Savings eaten away by money creation and negative interest...

Read More »Bank Of England Warns “Bigger Systemic Risk” Now Than 2008

Bank of England warn that “bigger systemic risk” now than in 2008 BOE, Prudential Regulation Authority (PRA) concerns re financial system Banks accused of “balance sheet trickery” -undermining spirit of post-08 rules EU & UK corporate bond markets may be bigger source of instability than ’08 Credit card debt and car loan surge could cause another financial crisis PRA warn banks returning to similar practices to...

Read More »“Financial Crisis” In 2017 Or By End Of 2018 – Prepare Now

“Financial Crisis Of Historic Proportions” Is “Bearing Down On Us” John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major...

Read More »“Financial Crisis” Of Historic Proportions Is “Bearing Down On Us”

“Financial Crisis Of Historic Proportions” Is “Bearing Down On Us” John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major...

Read More »In Gold we Trust Report: Must See Gold Charts and Research

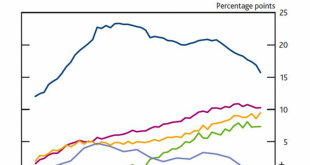

In Gold we Trust Report: Bull Market Will Continue The 11th edition of the annual “In Gold we Trust” is another must read synopsis of the fundamentals of the gold market, replete with excellent charts by our friend Ronald-Peter Stoeferle and his colleague Mark Valek of Incrementum AG. Gold Bull Market - Click to enlarge Key topics and takeaways of the report: – “Sell economic ignorance, buy gold …” – Many signals...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org