See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Bubble Conditions The price of gold was down about fifteen Federal Reserve Notes this week. The price of silver was down sixty-two copper-plated zinc pennies. Is the Federal Reserve Note a suitable instrument with which to measure gold? Can one really use debased pennies – which aren’t even made of the base metal copper...

Read More »Silver Kangaroo Coins – Sales Surge To Over 10 Million

Silver kangaroo coins have seen sales surge to over 10 million coins which is double the expected demand for the year. Silver Kangaroo Coins 1 oz (2016) Introduced to the market less than 11 months ago in September 2015 at a launch attended by GoldCore, sales of the new release Perth Mint’s 2016 Australian Kangaroo 1 ounce silver bullion coin were anticipated to reach 5 million coins in their introductory first year....

Read More »The Dollar Is Going to 1/10,000 Ounce – One Day

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. An image from the future: the US dollar, which one of these days is going to sink. Alas, there is many a slip ‘twixt the cup and the lip… Image via pinterest.com The Long Term vs. Trading Ideas The price of gold was up about thirty bucks this week. The price of silver was up almost seventy cents. Last week, a reader...

Read More »End of an Era: The Rise and Fall of the Petrodollar System

The Transition “The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better.” Ron Paul The intricate relationship between energy markets and our global financial system, can be...

Read More »A Sense of Foreboding

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Amerexit and Brexit… Doubts About Debt This was a shortened week, due to the American holiday of July 4, celebrating the start of the war that lead to “Amerexit”, 240 years ago. The prices of the metals were up this week, +$25 in gold and +$0.48 in silver. The gold to silver ratio dropped a fraction of a point, showing...

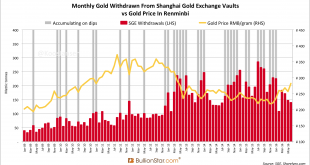

Read More »Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year. Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 – when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE...

Read More »Silver – OMG!

A hi-ho silver moment… Photo credit: Pat Corkery, United Launch Alliance Going Parabolic From Wednesday through Friday, the price of silver spiked massively. It ended the week about $2 higher than the previous week. The last time we recall silver price action like this was about 3 years ago, in August 2013. That one week, the price rose about $2.50. Before that was a week in August 2012, with a price gain of about...

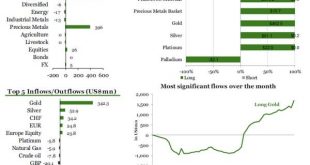

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

Read More »Brexit Drives Gold Frenzy

He should have known… (the cartoon shows a list of polls of “Dewey wins by landslide” or “Trump will never win the primaries” quality…) Markets Blindsided by Brexit The big news this week was that the British voted to exit the European Union. This was not the outcome expected by pundits, or the polls. “Risk on” assets were relentlessly bid up prior to the vote. For example, S&P 500 index futures had closed the...

Read More »Soft and Softer Silver Fundamentals

It was just a thought…. Cartoon by Bob Rich Loose Monetary Policy Remains in Place Last week, we asked where then will silver go. Well, the price moved around this week, dipping on Thursday but then rebounding sharply on Friday. It closed up 13 cents from last week. The price of gold rose $24. This week, the Federal Reserve announced that it will not hike rates. Most economists (and traders) have long been expecting a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org