Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely. Dots look like inflationary success if possibly even now more likely, whereas yields and especially bills have (re)taken a more skeptical approach pricing almost no chance for it. Buried in the FOMC minutiae on Wednesday was an upward adjustment...

Read More »FX Daily, April 8: Calm Capital Markets See the Dollar Drift

Swiss Franc The Euro has fallen by 0.26% to 1.1003 EUR/CHF and USD/CHF, April 8 (see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global stocks are moving higher today. Fears of a new lockdown in Tokyo amid rising covid cases weighed on Japanese stocks, a notable exception as the MSCI Asia Pacific Index rose for its fifth session of the past six. Europe’s Dow Jones Stoxx 600 is edging to new record highs today...

Read More »FX Daily, January 28: A Sea of Red Gives the Dollar a Bid

Swiss Franc The Euro has risen by 0.02% to 1.0764 EUR/CHF and USD/CHF, January 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The steepest loss in US equities since last October is rippling through the capital markets in the form of de-risking. The rout is not over, and the S&P 500 is poised to gap lower. Many of the largest markets in the Asia Pacific region were off around 2%. The nearly 1% loss in...

Read More »FX Daily, January 27: The Fed and Earnings on Tap

Swiss Franc The Euro has fallen by 0.27% to 1.075 EUR/CHF and USD/CHF, January 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites seem subdued even if GameStop’s surge draws attention. Asia Pacific equities mostly slipped lower, and profit-taking was seen in Hong Kong and Seoul, which are off to an incredibly strong start to the year. Small gains were reported in Tokyo, Beijing, and Taipei....

Read More »FX Daily, January 25: A Subdued Start to a Big Week

Swiss Franc The Euro has risen by 0.01% to 1.0771 EUR/CHF and USD/CHF, January 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: What promises to be an eventful week has begun off on a mostly subdued note. Asia Pacific equities moved higher, again led by Hong Kong and ostensibly mainland buying. The Hang Seng rose 2.4% to bring this year’s gain to 10.75%. South Korea’s Kospi also increased by more than 2%, and,...

Read More »FX Daily, November 5: The Dollar Slides and the Yuan Jumps

Swiss Franc The Euro has risen by 0.22% to 1.0719 EUR/CHF and USD/CHF, November 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets did not wait for the final vote count and took stocks and bonds higher while pushing the greenback lower. While it appears Biden will be the next US President, investors seemed to like the fact that his agenda will be checked by a Senate that may remain in Republican...

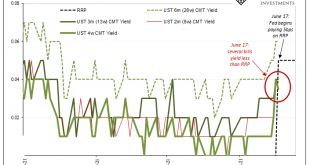

Read More »Wait A Minute, What’s This Inversion?

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board. And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute. That’s the part which caused so...

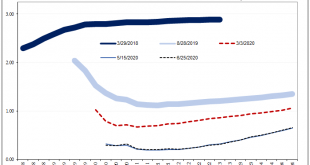

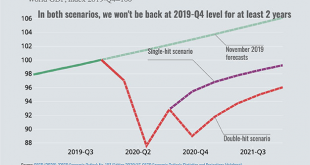

Read More »This Thing Is Only Getting Started; Or, *All* The V’s Are Light On The Right

The Federal Reserve’s models really are the most optimistic of the bunch. With the policy meeting conducted today, no surprises as far as policies go, we now know what ferbus has to say about everything that’s happened this year. Skipping the usual March projections, what with the FOMC totally occupied at the time by a complete global monetary meltdown Jay Powell now says “we saw it coming”, the central bank staff released the calculations performed by its DSGE...

Read More »Why The FOMC Just Embraced The Stock Bubble (and anything else remotely sounding inflationary)

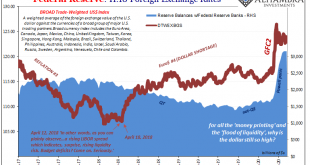

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t). This provides the financial services industry with the rationalization those working within it desperately want for them to do what they...

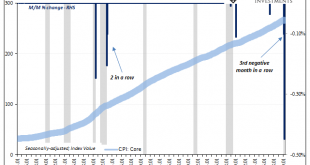

Read More »So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal. That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected. Realizing this is true does not cancel your vigilantism. For two years...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org