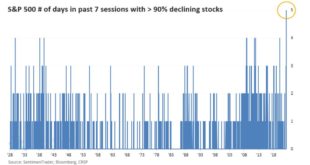

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

Read More »Everything Hitting The Global (eurodollar) Wall

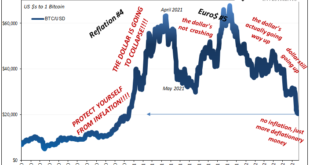

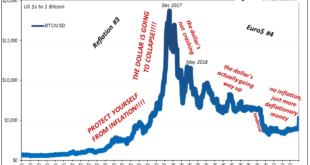

Over the weekend, Bitcoin tumbled again. Reaching an ultra-ugly low of $17,641 (before retracing back above $20k), even the self-styled premier digital “store of value” has thrown in the towel. As I wrote last week, winter isn’t coming it is here. One crucial reason why, the Japan’s Ministry of Finance reported last week how imports into that country during the tumultuous month of April surged by a frankly ridiculous 48.9% year-over-year. It was the biggest annual...

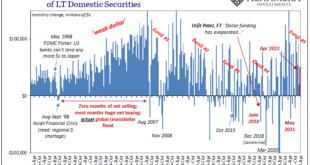

Read More »Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system. This much was apparent right from the start, with financial markets gone haywire three months ago (mid-March seasonal bottleneck), and then more of the same into April right to now. The updated TIC data for the month of...

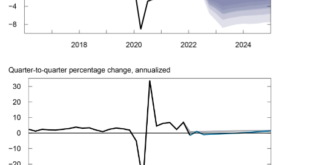

Read More »Sorry Chairman Powell, Even FRBNY Now Has To Forecast Serious and Seriously Rising Recession Risk

At his last press conference, Federal Reserve Chairman Jay Powell made a bunch of unsubstantiated claims, none of which were called out or even questioned by the assembled reporters. These rituals are designed to project authority not conduct inquiry, and this one was perhaps the best representation of that intent. Powell’s job is to put the current predicament in the best possible light, starting by downplaying the current predicament. From there, to try to get the...

Read More »Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay. The short end of the yield curve (USTs and elsewhere) is plotting like FOMC dots, whenever oil and crude...

Read More »It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer. It’ll be revised history when ultimately the mainstream attempts to write it over the months ahead, many will try to snatch some limited victory from the jaws of defeat. Should recession happen and bring an end to the...

Read More »Prices As Curative Punishment

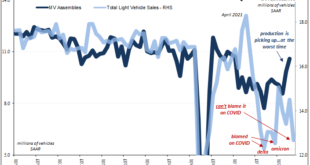

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022. At a seasonally-adjusted annual rate of 12.7 million, it was a quarter fewer than sales put down in May 2021 and 13% below the not-great level from the month prior in April 2022. Such puny results have typically been reserved for those...

Read More »Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data. It is the jobs market where much of the official “inflation” jawboning is centered, all that Phillips Curve stuff. So, whatever might seriously undermine Phillips would put the end to the rate hikes in sight. Short-term Treasuries therefore ignored...

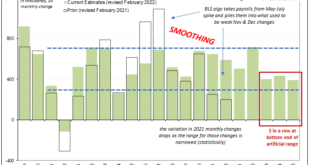

Read More »Simple Economics and Money Math

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips). That as much because of the other employment figures, the Household Survey. April and May, in particular, not just a slowdown but a drop in overall employee count. As I pointed out last Friday, a 2-month...

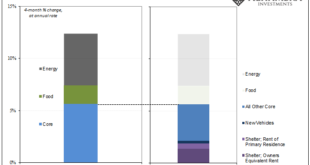

Read More »“Inflation” Not Inflation, Through The Eyes of Inventory

It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices. Who cares, most people wonder. After all, what does it really matter why prices are going up so far? The pain this causes is pain regardless of any post hoc pedantry. Insisting on proper terminology, however, is an attempt...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org