The virus numbers in the US show no signs of slowing; the dollar should continue to soften October retail sales Tuesday will be the US data highlight for the week; Fed manufacturing surveys for November will start to roll out; the Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors Canada has an important data week; Brexit talks will (hopefully) wind up soon; UK reports key data Japan and Australia have...

Read More »Ex-Credit Suisse boss recruited by Rwandan government

Thiam radically reshaped Credit Suisse Keystone Tidjane Thiam, who resigned as CEO of Swiss bank Credit Suisse in February, has been tasked with using his connections to build up the Rwandan capital Kigali as an international business location, according to Swiss business newspaper Handelszeitung. Ivory Coast-born Thiam, who also holds French citizenship, has been named president of Rwanda Finance Limited, a government company that is to set up the Kigali...

Read More »Will vaccination campaign convince hesitant Swiss?

Just 16% of Swiss would immediately get vaccinated against coronavirus, according to a recent survey Keystone Faced with considerable public scepticism towards a Covid-19 vaccine, the Federal Office of Public Health is preparing an information campaign about vaccinations. However, the country’s top hospital hygienist thinks offering incentives is a better way to make people get a jab. Just 16% of Swiss would immediately get vaccinated against coronavirus, according...

Read More »Prepare for Winter

Realism must precede optimism or the optimism will collapse as the tsunami of reality comes ashore. It’s time to prepare materially and psychologically for a winter unlike any other in our lifetimes. Here’s the view from 30,000 feet: 1. The stock market and the general zeitgeist of optimism have soared based on expectations that the real-world economy and efforts to suppress Covid would also track a V-shaped recovery. While GDP did make a V-shaped recovery, GDP...

Read More »James Mill: Laissez-Faire’s Lenin

[An Austrian Perspective on the History of Economic Thought (1995)] James Mill (1771–1836) was surely one of the most fascinating figures in the history of economic thought. And yet he is among the most neglected. Mill was perhaps one of the first persons in modern times who might be considered a true “cadre man,” someone who in the Leninist movement of the next century would have been hailed as a “real Bolshevik.” Indeed, he was the Lenin of the radicals, creating...

Read More »Vote November 29: Spotlight on ethical business practices

A proposal to make Swiss-based multinationals accountable for their business practices abroad is tabled for a nationwide vote on November 29. An initiative aimed at restricting investments in the arms industry is the second issue on the ballot sheet. The political left is trying to push through amendments to the Swiss constitution to impose sustainable standards on Swiss companies and institutions, which has triggered opposition from the political right and the...

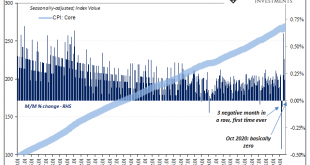

Read More »Where Is It, Chairman Powell?

Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance. Inflationary pressures were supposed to have been visible by now, seven months and counting, when instead it is disinflation which is most evident...

Read More »Swiss advance plans to take goods transport underground

This kind of vehicle will be used to transport goods under Central Switzerland (computer-generated illustration). Keystone Building a 500-km tunnel network to transport goods under Central Switzerland is the ambitious aim of the “Cargo Sous Terrain” project. The vision has moved closer to reality since the Swiss government brought forward enabling legislation last month. In the not-too-distant future, part of the goods now transported by road or rail between Geneva...

Read More »Here’s What Donald Trump Should Do Before Inauguration Day

Even if he loses, Donald Trump still has time to change military policy, pardon allies, unseat the Federal Reserve Board of Governors, and throw a wrench in the deep state apparatus. Original Article: “Here’s What Donald Trump Should Do Before Inauguration Day“. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack. You Might Also Like The COVID Crisis Supercharged...

Read More »‘Artificial intelligence won’t replace humans’

A sculpture made from electronic components by the artist Muharrem Batman for the 2018 “Artificial Intelligence and Robotics” exhibition at the Heinz Nixdorf MuseumsForum, a computer museum in Paderborn, Germany. Keystone / Guido Kirchner Artificial intelligence (AI) is gaining ground in our societies, posing a threat to jobs and increasingly invading our private lives. A new centre for AI research at the federal technology institute ETH Zurich wants to put people at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org