Fritz Zurbrügg (links) tritt Ende Juli 2022 zurück. Andréa M. Maechler (rechts) dürfte ihm als Direktorin des III. ins II. Departement folgen. (Bild: PD) Fritz Zurbrügg leitete zunächst das III. Departement (Finanzmärkte, Operatives Bankgeschäft und Informatik) der Schweizerischen Nationalbank. Seit Juli 2015 führt er als Vizepräsident des Direktoriums das II. Departement (Finanzstabilität, Bargeld, Finanzen und Risiken). Seine Tätigkeit bei der SNB stand im Zeichen...

Read More »Swiss trade union demands shorter work week

© Keystone / Gaetan Bally Switzerland’s largest trade union issued a statement on Saturday demanding a “massive reduction” of working hours with full wage compensation for lower and income earners. “Nowhere in Europe do people work as hard as in Switzerland. At present, employees work an average of 41.7 hours per week in a full-time job,” the union noted in a statement after its 66 delegates met in the Swiss capital, Bern. While the number of hours worked has...

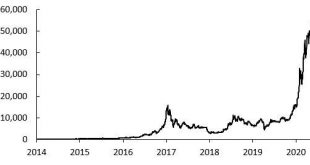

Read More »Bitcoin Isn’t Any More Dangerous than the Euro

Major representatives of the European Central Bank—including ECB president Christine Lagarde—continue to warn against bitcoin. In a recent article, addressed to the inflation-adverse German audience, the ECB representative Klaus Masuch together with the former ECB chief economist Otmar Issing has stressed five risks of bitcoin: a lack of intrinsic value, risks to financial market stability, the use in financing organized crime, high energy consumption, and the...

Read More »Devisen: Euro gibt zum Dollar moderat nach – Franken etwas leichter

Der Franken neigt dagegen zum Wochenstart etwas zur Schwäche. Entsprechend legen sowohl Euro als auch Dollar zum Schweizer Franken etwas zu. So hat sich das Euro/Franken-Paar bei einem Stand von 1,0418 die 1,04er Marke zurückerobert, nachdem es am vergangenen Freitag so tief notiert hatte wie zuletzt vor sechseinhalb Jahren. Der US-Dollar hat sich die 0,92er Marke zurückerobert und geht aktuell zu 0,9221 Franken um. Wie die jüngsten Daten am Morgen gezeigt haben,...

Read More »FX Daily, December 6: Semblance of Stability Returns though Geopolitical Tensions Rise

Swiss Franc The Euro has risen by 0.26% to 1.041 EUR/CHF and USD/CHF, December 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The absence of negative developments surrounding Omicron over the weekend appears to be helping markets stabilize today after the dramatic moves at the end of last week. Asia Pacific equities traded heavily, and among the large markets, only South Korea and Australia escaped unscathed...

Read More »Bitcoin Capital Rolls Out New Crypto ETPs on the Swiss Stock Exchange

Bitcoin Capital has expanded its crypto asset offerings by launching two new crypto exchange-traded products (ETPs) on the SIX Swiss Exchange. The new products, 1 FiCAS Active Bitcoin ETP and 1 FiCAS Active Ethereum ETP, are actively managed by crypto asset manager FICAS AG, a statement from the company said. Bitcoin Capital is a subsidiary of FiCAS AG, a Swiss-based crypto investment management boutique. The listing is accessible for investments by institutional,...

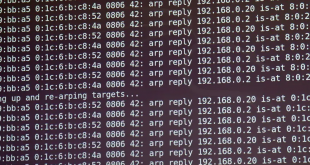

Read More »Ransomware attacks on the rise in Switzerland

Ransomware is a type of malicious software that threatens to publish or freeze access to data or a computer system until the victim pays a ransom fee to the attacker. Keystone / Ronald Wittek Cyber-attacks are on the rise in Switzerland with 94 ransomware incidents reported in the first half of the year, according to the Sunday weekly Le Matin Dimanche. The source of that figure is the network supporting investigations against digital crime (NEDIK) but the president...

Read More »Planned Chaos

The characteristic mark of this age of dictators, wars, and revolutions is its anti-capitalistic bias. Most governments and political parties are eager to restrict the sphere of private initiative and free enterprise. It is an almost unchallenged dogma that capitalism is done for and that the coming of all-around regimentation of economic activities is both inescapable and highly desirable. Nonetheless capitalism is still very vigorous in the Western Hemisphere....

Read More »The highs and lows of living and working in Switzerland

The Ferris wheel in front of Lausanne Cathedral. Almost all expats are happy with the city’s urban environment Keystone / Jean-christophe Bott Last year foreign workers in Switzerland loved the quality of life but moaned about how hard it is to settle in. Have they since cracked how to befriend the allegedly surly Swiss? The Expat City Ranking 2021 lists both praise and peeves of newcomers. It’s good news for Basel, which has improved from 24th to 9th in this year’s...

Read More »Africa’s Long History of Trade and Markets

Market reforms in Africa can be thwarted because of propaganda asserting that markets are a Western import. Notwithstanding the currency of this belief, it is patently absurd. Markets flourished in Africa prior to colonialism, and wherever they are repressed, the result is social immiseration, as economist William Hutt points out in his pathbreaking study, The Economics of the Colour Bar. Merchants in precolonial Africa organized large-scale trading networks that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org