Ludwig von Mises's contributions to the development of the technical methods and apparatus of monetary theory continue to be neglected today, despite the fact that Mises succeeded exactly eight decades ago, while barely out of his twenties, in a task that still admittedly defies the best efforts of the most eminent of modern monetary theorists, viz., integrating monetary and value theory. Such a unified and truly "general theory" is necessary to satisfactorily...

Read More »SNB dumps FANGS. Should You?

John Rubino and Patrick Highsmith of Firefox Gold return as guests on this week’s program. The Swiss National Bank (SNB) loaded up on some of the largest cap stocks in the world like MSFT, GOOG, AMZN, TSLA, XOM and many more in order to weaken the Swiss francs vis-a-vis the Euro and the Dollar. But these purchases have now resulted in a 132 billion Swiss francs loss in 2022, the biggest annual loss in the SNB’s history. The total amount of “Foreign currency...

Read More »Money versus Monetary Policy

Money is simple. The political program of monetary "policy" is not. Original Article: "Money versus Monetary Policy" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags: Featured,newsletter

Read More »The Power of Woke: How Leftist Ideology Is Undermining Our Society and Economy

“It’s an important part of society whether you like it or not,” lexicologist Tony Thorne, referring to “wokeness,” told The New Yorker’s David Remnick in January. That’s an understatement. Wokeness is poisoning the Western workplace and constraining small and family businesses, midsized banks, and entrepreneurs while enriching powerful corporations and billionaires. It’s eating away at the capitalist ethos and killing the bottom-up modes of economic ordering and...

Read More »Supporters Summit 2023

Save the date! Join us for our 2023 Supporters Summit, October 12–14, at the Mises Institute in Auburn, Alabama. Lew Rockwell and Jeff Deist will host a weekend filled with engaging discussion and social time with other Mises members and speakers. We'll open Thursday evening, October 12 with a reception in Auburn. Friday, October 13, we'll have discussions and lunch at the Institute and close with a dinner at the new and unique Botanic in Opelika. Saturday, we'll...

Read More »Food and Shelter Prices Keep Climbing as CPI Growth Hits a Three-Month High

We're still living with the consequences of the massive monetary inflation by Trump and Biden. Prices are stubbornly high, and falling real wages are driving Americans to say things are getting worse. Original Article: "Food and Shelter Prices Keep Climbing as CPI Growth Hits a Three-Month High" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Investors Shaken by Rising Rates

Overview: The surge in US interest rates and sharp losses in US stocks sent the dollar broadly higher in North America yesterday. The $42 bln of two-year notes auctioned by the US Treasury saw the highest yield in more than a quarter-of-a-century (4.67%) and it still produced a small tail. Sterling, helped by its own surprisingly strong data, was the only G10 currency to have gained against the surging dollar. Still, no important technical levels were breached,...

Read More »If We No Longer Pay Attention to Things We Don’t Control, What’s Left For Us to Focus On?

Our time is better invested in actually learning about trends that impact us directly. Imagine making this simple change in your life: whatever you don’t control, you stop paying attention to it.This includes a vast array of “news” and “crises” that we have zero control over: the wretched flooding in Timbukthree, geopolitics, distant wars, macro-economic trends, politics above the micro-local level, and so on. Once we stop paying attention to everything we don’t...

Read More »Upside Surprise in UK’s Flash PMI and Better-than-Expected January Public Finances Lift Sterling

Overview: Rising interest rates are weighing on risk appetites and the dollar is broadly stronger. Sterling is a notable exception after a stronger than expected flash PMI and better than expected public finances. The correlation between higher US rates and a weaker yen is increasing and the greenback looks poised to rechallenge the JPY135 area. A slightly better than expected preliminary PMI and hawkish minutes from the recent RBA meeting has done little to support...

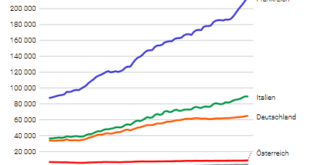

Read More »The number of cross-border commuters rose by 6.1% in 4th quarter 2022 over a one-year period

21.02.2023 – The number of workers holding a cross-border commuter permit (G permit) increased by 6.1% between the 4th quarters of 2021 and 2022 with 380 000 persons. Their share in the employed population was 7.3% (+0.4 percentage points). These are the findings of the Cross-border Commuter Statistics, conducted by the Federal Statistical Office (FSO). . Download press release: The number of cross-border commuters rose by 6.1% in 4th quarter 2022 over a one-year...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org