American and European political elites seem to be wanting the Russia-Ukraine war to be fought to the last Ukranian and have done nothing to bring peace. It's time for a change. Original Article: "Just Say No to the New Forever War" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags:...

Read More »Week Ahead: February ISM Services and Auto Sales to Show January US Data were Exaggerated

A key issue facing businesses and investors is whether the US January data reflects a reacceleration of the world's largest economy or whether it was mostly a payback for extremely poor November and December 2022 data and seasonal adjustments and methodological distortions. Given the centrality of the US economy and rates, it is not simply a question for America, the Federal Reserve, and investors, but the implications are much broader. The issue is unlikely to be...

Read More »Business Cycle Intel Report

Mark uses Intel Corporation, the computer chip manufacturer, as a barometer of the business cycle. He looks at the stock price in recent years, its production capacity expansion, and the company's very recent cost- and dividend-cutting moves. Check out Mark Thornton's free book, The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century: Mises.org/Curse Be sure to follow Minor Issues at Mises.org/MinorIssues....

Read More »Making Nonsense from Sense: Debunking Neo-Calvinist Economic Thought

A few years ago I wrote about some of the errors made by economists who try to apply what they believe are Christian principles to both Austrian and neoclassical economic analysis. These economists believe that the standard economic way of thinking is not only fatally flawed but actually immoral, and that an entire new paradigm must be brought to economics. In the mid-1990s, I taught economics as an adjunct at a Christian college near Chattanooga, being essentially...

Read More »The Politicization of Procreation: The Ultimate in “the Personal Is Political”

Gloria Steinem declared, "The personal is political." Today, politics has reached into family life and even procreation itself, an unhappy trend for unhappy people. Original Article: "The Politicization of Procreation: The Ultimate in "the Personal Is Political"" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »China’s Emerging Global Leadership Isn’t Just the Result of Subsidies: Entrepreneurship Still Matters in This Market

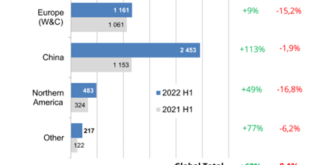

China has become a global leader in the electric vehicles (EVs) sector, and Western governments are worried that its comparative advantage will become entrenched. Once again, mainstream pundits blame China’s success on government subsidies and unfair competition. This is just a pretext to argue for more government support in a sector which, from the very beginning, has not been driven by genuine consumer demand but by a political green agenda. China Leads in the...

Read More »The Economics of National Divorce, Part II

Tom Woods joins the show for a look at the hottest political topic of the day, namely national divorce. This is a spirited discussion of the politics, economics, and mechanics of how America might break up. Watch "The Economics of National Divorce, Part I" with Ryan McMaken: Mises.org/HAP352 [embedded content] [embedded content]...

Read More »Mill at a Loss

On John Stuart Millby Philip KitcherColumbia University Press, 2023; 152 pp. John Stuart Mill wasn’t Murray Rothbard’s favorite philosopher, and Philip Kitcher’s short book would confirm this dislike. Rothbard viewed Mill as a fuzzy thinker, overly prone to compromise and averse to firm principles. These qualities are among those that lead Kitcher to praise Mill, but Rothbardians nevertheless have much to learn from Kitcher, who is a leading analytic philosopher,...

Read More »Why Libertarians Should Support the Multipolar World

Western intellectuals and their political allies are pushing relentlessly toward a unipolar world. Freedom lies in the multipolar direction. Original Article: "Why Libertarians Should Support the Multipolar World" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags:...

Read More »Artificial Intelligence Can Serve Entrepreneurs and Markets

Marketplace competition is reaching a new high with the era of artificial intelligence—deep machine learning capabilities offered to the entrepreneur as specialized services. AI tools as services spanning the marketplace are popping up at a rate that is seemingly increasing firms’ productivity and competitiveness. However, what implications do offering AI and deep learning as a service have for market operations, buyers, and sellers? When AI services and custom...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org