When Murray Rothbard established a realignment in libertarian thought, his standard was determined by sovereignty rather than bipartisanship. A right-wing populist platform might be the most popular campaign strategy in the last few years. Since Brexit, a trend has swept a wide range of the globe. The question remains what this political revolution should be called. If it were a daring step away from the establishment, spectators might be concerned as to why so many...

Read More »From Bastiat’s Defense of Exchange to Ideal Government

Frédéric Bastiat is justifiably famous among believers in liberty. His many classic contributions include The Law and his essays “Government” and “That Which Is Seen and That Which Is Not Seen,” not to mention some of the best reductio ad absurdum arguments ever (such as “The Candlemakers’ Petition” and “The Negative Railway”) and more. Less well known are other essays, such as his election manifesto of 1846, which illustrated what a principled politician who...

Read More »Modern Portfolio Theory Is Mistaken: Diversification Is Not Investment

According to modern portfolio theory (MPT), financial asset prices always fully reflect all available and relevant information, and any adjustment to new information is virtually instantaneous. Thus, asset prices respond only to the unexpected part of information since the expected portion is already embedded in prices. For example, if the central bank raises interest rates by 0.5 percent, and if market participants anticipated this action, asset prices will reflect...

Read More »A Free and Open Internet Is a Threat to the Establishment

Last week, a video clip of Francis Fukuyama went viral. In the clip, the political scientist called freedom of speech and a marketplace of ideas “18th century notions that really have been belied (or shown to be false) by a lot of what’s happened in recent decades.” Fukuyama then reflects on how a censorship regime could be enacted in the United States. But the question then becomes, how do you actually regulate content that you think is noxious, harmful, and the...

Read More »Swiss banker pleads guilty to tax offences in the US

A Swiss banker has pleaded guilty to tax offences in the United States. Between 2008 and 2014, he allegedly helped wealthy US clients hide their assets from the US authorities in accounts at Zurich-based Ihag Privatbank. Share Facebook Twitter E-mail Print Copy link The former head of the Zurich-based Allied Finance Trust, a subsidiary of the Liechtenstein-based Allied Finance Group, and his “co-conspirators” transferred more than $60 million (CHF51.4 million)...

Read More »Macro: GDP Q3 — Inflationary BOOM!

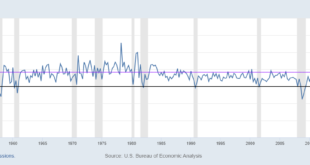

Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years. It was the best real growth quarter since Q2 and Q3 of 2014. The last 12 months has been mostly about services, here are the biggest contributors to YoY GDP: Consumption of Services Consumption of Goods Lower imports Government Non-residential investment in structures Intellectual property Q2 to Q3, we saw an acceleration in goods...

Read More »Macro: Philly Fed Mfg Survey — Umm

Tis was a poor number. The headline dropped from -5.9 to -10.5. The more eye popping number was the Index for New Orders which dropped from 1.3 to -25.6. I hate to say it, the diffusion index for new orders has never gone below 21 without an accompanying recession; that is until 2023. This is the 4th reading in the last 13 months below 21. These regional manufacturing surveys have been relatively poor since the middle of 2022. To date, it hasn’t mattered. Its as if...

Read More »USD/CHF heading for 0.8500 as Swiss Franc climbs into four-month high against Greenback

Share: The Swiss Franc is testing further high ground against the US Dollar on Thursday. Risk appetite is cranking up after US inflation data tips lower. US Dollar declines across the board ahead of the holiday market wrap. The USD/CHF slipped through the 0.8600 handle on Thursday as broader markets push over the US Dollar (USD), bolstering...

Read More »Swiss budget agreed with humanitarian spending cut

read aloud pause X Switzerland’s parliament has finalised the 2024 budget after agreeing to a CHF10 million cut on humanitarian funding. Share Facebook Twitter E-mail Print Copy link On Thursday, the House of Representatives and the Senate chambers cleared up the last budget disagreements. The last sticking point was whether to retain or cut Swiss funding for the UN Agency for Palestinian Refugees (UNRWA).+ Budget: extraordinary spending...

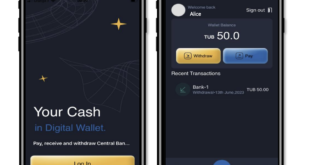

Read More »Swiss-Backed CBDC Project Explored Feasibility of Cash-Like, Anonymous Digital Currency

Project Tourbillon, an initiative led by the Bank for International Settlements (BIS) Innovation Hub Swiss Centre and supported by the Swiss National Bank (SNB), explored the feasibility of a retail central bank digital currency (CBDC), finding that it is possible to implement a CBDC design that provides anonymity to the payer and which is scalable and secure. In a new report released in November 2023, BIS shares details of the project, outlining findings of their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org