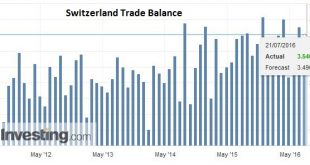

Swiss Franc The Swiss trade balance was published today, and once again, it remained close to record-high. For us, the trade balance is the most important indicator if a currency is fairly valued. Over the long-term the Swiss trade surplus must adjust towards zero, while the currency must appreciate. The consequence of the stronger currency is a higher purchasing power which leads to more spending and finally more...

Read More »Effective Fed Funds and Money Markets

Summary: Fed funds have been trading firmly. There are several reasons and one of them is the shift that is taking place in the US money markets. Still the risk of a Fed hike has increased, just as speculation increases of easing in other major centers. The weighted average of the Fed funds rate has edged higher. Following the Fed hike in December 2015, the Fed funds average around 36 bp in January before...

Read More »Draghi Does not Surprise and Euro Edges Away from $1.10

Summary: Draghi does not show the kind of urgency many bank economists do over the shortage of bonds to buy. Draghi kept options open and suggested a review in September when new staff forecasts are available and more data will be seen. The euro firmed, mostly it seemed on sell the rumor buy the fact, and/or possibly some disappointment that no fresh action was taken. Draghi said nothing that surprised the...

Read More »US To Seize $1 Billion In Embezzled Malaysian Assets Which Goldman Sachs Helped Buy

The last time we wrote about the long-running saga of the scandalous collapse and constant corruption at the Malaysian state wealth fund, 1MDB, which also happened to be an unconfirmed slush fund for president Najib, was a month ago when we learned that the NY bank regulator was looking into fundraising by the fund’s favorite bank, Goldman Sachs. Then overnight, the story which already seemed like it has every possible...

Read More »The Central Planning Virus Mutates

Chopper Pilot Descends on Nippon Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect. Amid stubbornly stagnating economic output, Japan has amassed a debt pile so vast since the bursting of...

Read More »The Day They Killed the Dollar

Hell With Air-Conditioning LAS VEGAS – It was 113 degrees outside when we rolled through Baker, California, a few days ago. We drove along in comfort, but our sympathies turned to the poor pilgrims who made their way to California in covered wagons. How they must have suffered! Our suffering didn’t begin until we checked into the Planet Hollywood Hotel in Las Vegas. What a horrible place. You stand in line for half...

Read More »The World’s Central Banks Are Making A Big Mistake

Authored by John Mauldin via MauldinEconomics.com, While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national...

Read More »Great Graphic: Aussie Approaches Two-Month Uptrend

Summary: Australian dollar is the second heaviest currency this week after a key downside reversal at the end of last week. It is approaching an uptrend line near $0.7450. Many perceive an increased likelihood that the RBA eases and many are reassessing chance of a Fed hike later this year. Australian dollar The Australian dollar recorded a key downside reversal last Friday (July 15) and had seen follow...

Read More »The Curious Case of Vanishing Lady Liberty; Only Gold and Silver Remember Her

The very first word anyone ever saw on a circulating United States coin was the word “LIBERTY.” From half-cents to silver dollars, each featured the likeness of an unnamed woman. The images varied, thanks to different engravers, but together they became recognized as Lady Liberty. Many, maybe most, of young America’s citizens were illiterate. “Liberty” may have been the first word they ever learned to read. If not,...

Read More »Dollar Bull Case Intact: It is All About the Perspective

Summary: Our bullish dollar outlook was based on divergence and we judge it to still be intact. The Dollar Index has been trading broadly sideways since March 2015, but never did more than a minimum retacement of its earlier rally. The Dollar index is at it highest level since March today. Our underlying constructive outlook for the US dollar remains intact. It is broadly based on the divergence between the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org