The Market Has its Head Buried Deep In The Sand Several “black swans” are looming which could inflict a financial nuclear accident on the U.S. markets and financial system. I say “black swans” in quotes because a limited audience is aware of these issues – potentially catastrophic problems that are curiously ignored by the mainstream financial media and financial markets. The most immediate problem is the Treasury...

Read More »Blocher and the People That Ruined the EU

Last weekend, European leaders gathered in Rome for the 60th anniversary of the Treaty of Rome. They discussed, not for the first time, how to get the EU back on track. And they told each other they are still committed to the Union and believe in its future. (We’ve heard that one before, too.) But let’s just suppose that, when the European leaders sat down for lunch at the Quirinal Palace, some of them had a little too...

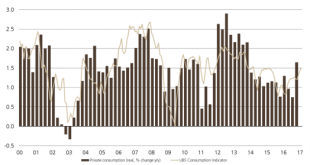

Read More »Switzerland UBS Consumption Indicator February: Domestic tourism rising

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator rose to 1.50 points in February from 1.44, indicating solid private consumption in the first quarter. Domestic tourism bottomed out and then rose significantly in January. On the...

Read More »Cool Video: “Turn Around Tuesday” Call in Early Asia Yesterday

Source: cnbc.com - Click to enlarge I had time this afternoon, as I prepare for my TMA presentation tomorrow night here in Hong Kong, to find my clip from yesterday on CNBC, where I suggested the risk of a dollar recovery after it lost downside momentum in North America on Monday. There has not been much follow through today, though the euro broke below $1.08 in late-Asia and is maintaining the break in early...

Read More »Cool Video: Brexit, Europe and EU Challenges

Earlier today, I had the opportunity to discuss the outlook for sterling and the US dollar on Bloomberg TV with Rishaad Salamat and Haidi Lun. It is a momentous day with Article 50 of the Lisbon Treaty being formally triggered by UK Prime Minister May, nine months after what was, at least initially, a non-binding referendum. European Council President Tusk is expected formally to respond for the EU before the...

Read More »Price Inflation – The Ultimate Contrarian Bet

Unanimity Syndrome If there is one thing apparently no-one believes to be possible, it is a resurgence of consumer price inflation. Actually, we are not expecting it to happen either. If one compares various “inflation” data published by the government, it seems clear that the recent surge in headline inflation was largely an effect of the rally in oil prices from their early 2016 low. Since the rally in oil prices...

Read More »India: The next Pakistan?

India’s Rapid Degradation This is Part XI of a series of articles (the most recent of which is linked here) in which I have provided regular updates on what started as the demonetization of 86% of India’s currency. The story of demonetization and the ensuing developments were merely a vehicle for me to explore Indian institutions, culture and society. Tribal cultures face an inherent contradiction. They create poison...

Read More »Jungfreisinnige fordern Taten statt Worte – Mittelstandsinitiative

(ll) – Der heute veröffentlichte Steuerbelastungsmonitor 2016 zeigt die Situation unverblümt auf: Der Kanton Zürich hat nach wie vor bei tiefen und höheren Einkommen ein Attraktivitätsproblem im kantonalen Steuervergleich. Darum setzen sich die Jungfreisinnigen Kanton Zürich mit der im Februar lancierten Mittelstandsinitiative für einen Kanton Zürich mit Zukunft ein. Der Steuerbelastungsmonitor 2016 führt eindrücklich...

Read More »Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

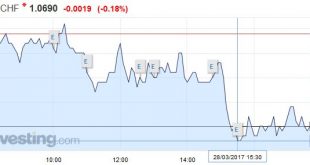

Headlines Week March 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Llst weeks: The EUR/CHF suddenly appreciated with the ECB...

Read More »FX Daily, March 28: Prospects for Turnaround Tuesday?

Swiss Franc EUR/CHF - Euro Swiss Franc, March 28(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc continues to hold the higher ground as global uncertainty continues to dominate the markets. UBS Consumption Indicator is released tomorrow morning which should give some further clues to as the health of the Swiss economy. The numbers are important as the consumption is the most important...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org