Swiss Franc The euro is up by 0.19% to 1.1348 CHF EUR/CHF and USD/CHF, August 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The downward pressure on US yields, with the 10-year slipping to 2.18%, nearly a two-month low, coupled drop in equities helped underpin the Japanese yen. The dollar traded below JPY109 for the first time since the middle of June. The greenback...

Read More »Would you take a pilotless plane?

Commercial aircraft already take off and land using their on-board computers (Keystone) Pilotless cargo and passenger planes could be in use within eight years and save airlines billions, according to a report by Swiss bank UBS. But customers remain wary of the new technology despite potential fare reductions. “In the not-too-distant future, we would expect to see a situation where flights are pilotless or the number of...

Read More »What Went Wrong With the 21st Century?

Fools and Rascals And it’s time, time, time And it’s time, time, time It’s time, time, time that you love And it’s time, time, time… – Tom Waits [embedded content] Tom Waits rasps about time POITOU, FRANCE – “So how much did you make last night?” “We made about $15,000,” came the reply from our eldest son, a keen cryptocurrency investor. “Bitcoin briefly pierced the $3,500 mark – an all-time high. The market cap of...

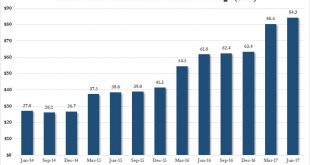

Read More »“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: the Japanese...

Read More »Unions demand 2 percent wage increase as economy improves

The unions say Swiss employees have had to make do with only modest salary increases or wage freezes in recent years. (Keystone) Staff should start enjoying the benefits of Switzerland’s improving economic performance, says the country’s second-largest trade union group, Travail. Suisse, which is demanding a 2% salary increase for workers. “It’s been some time since the economic perspectives have looked this positive....

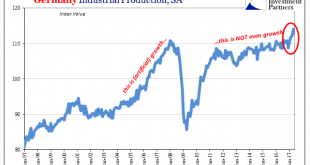

Read More »Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year. The move was considered by many if not most in the mainstream a prime example of Mario Draghi’s...

Read More »SNB Balance Sheet, Markets and Economy: As Good As It Gets?

Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004. It doesn’t even come close to the routine 4-5% year over year growth rates we saw in the late 90s....

Read More »FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

Swiss Franc The euro has depreciated by 0.13% to 1.1312CHF. EUR/CHF and USD/CHF, August 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The net impact is to lift the US dollar, yen and gold. The geopolitical tensions saw more profit-taking in equities. Debt markets are little changed, but the US Treasuries area a little firmer. We suspect that like yesterday, North...

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

Read More »Increased demand from Asia helps fill Swiss hotel rooms

Asian tourists helped offset a stagnant European demand (Keystone) The number of overnight stays in Swiss hotels rose by 4.4% in the first half of 2017 compared to the same period the year before. Tourists from India and China were largely responsible for the increase in demand. According to figures released by Federal Statistical Office on Monday, tourists – both domestic and international – spent a total of 17.6...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org