© Ifeelstock | Dreamstime.com In 2016, Switzerland’s government decided to tighten the VAT exemption on imported purchases, a move that affects most online orders from foreign retailers. The new rules took effect on 1 January 2019 – they were originally planned for 1 January 2018 but systems and processes were not ready. Until the beginning of this year, any order attracting less than CHF 5 francs of VAT was allowed...

Read More »More Unmixed Signals

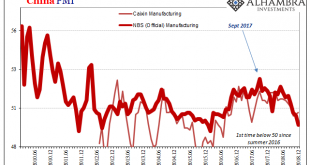

China’s National Bureau of Statistics (NBS) reports that the country’s official manufacturing PMI in December 2018 dropped below 50 for the first time since the summer of 2016. Many if not most associate a number in the 40’s with contraction. While that may or not be the case, what’s more important is the quite well-established direction. Coming in at 49.4 in December, it’s down in a straight line from 51.3 in August....

Read More »EU needs more flexible negotiation tactics: UBS chairman

Weber joined UBS as chairman following a stint as head of the German central bank. The European Union should stop dictating terms to Switzerland and start negotiating an acceptable compromise if it wants to find agreement on future ties, says UBS chairman Axel Weber. In an interview with the Tages-Anzeiger newspaper, Weber said the current EU demands are unlikely to be approved by the Swiss people should they be put to...

Read More »Mispriced Delusion

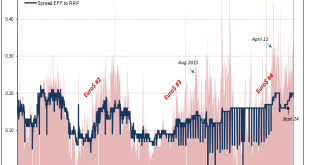

Recency bias is one thing. Back in late 2006/early 2007 when the eurodollar futures curve inverted, for example, it was a textbook case of mass delusion. All the schoolbooks and Economics classes had said that it couldn’t happen; not that it wasn’t likely, it wasn’t even a possibility. A full-scale financial meltdown was at the time literally inconceivable in orthodox thinking. A global panic, some sort of unserious...

Read More »Apple, China, Yen, and US Jobs: Welcome to 2019

The New Year is off to an auspicious start. The Japanese yen, the third most actively traded currency behind the dollar and euro, got caught in a vortex of a retail short squeeze, algos, and who knows what else. The US dollar plunged from around JPY109 to a slightly below JPY105 in a few minutes a little more than an hour after US markets closed yesterday. Japanese markets were still closed for the holiday, which may...

Read More »One in two Swiss is happy with personal finances

Swiss men are happier than women on the financial front. One Swiss in two is satisfied with the state of their financial situation, according to a study. Just under a third (28%) expect their finances to improve in 2019. The French-speaking population is feeling much more positive than last year. In 2018, one fifth of French-speaking Switzerland still believed that their financial situation was deteriorating, according...

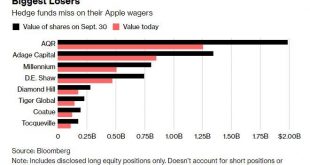

Read More »Hedge Funds, ETFs, Central Banks Suffer Billions In Losses On Apple

It wasn’t that long ago that Apple was the most beloved stock by the hedge fund community, and although in recent months the company’s popularity faded somewhat among the 2 and 20 crowd it is still one of the most popular names among the professional investing community. Which on a day that saw AAPL stock tumble as much as 10% is clearly bad news. As Bloomberg notes, eight hedge funds that own large stakes in Apple have...

Read More »Nothing To See Here, It’s Just Everything

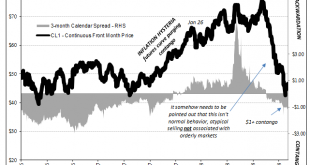

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal. In May, the Trump administration formally withdrew from the...

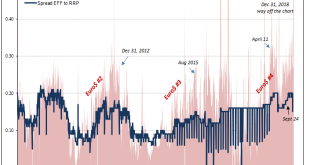

Read More »Insane Repo Reminds Us

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind...

Read More »GBP/CHF Forecast: Swiss Franc at Best Level against the Pound in over a year

GBP/CHF forecast: Brexit uncertainty causes Swiss Franc to gain vs the Pound The Pound is now trading at its lowest level to buy Swiss Francs in over twelve months as the political uncertainty surrounding the UK is continuing to negatively affect the value of Sterling exchange rates. Clearly the uncertainty of what may happen in the next three months before the end of March is causing investment in the UK to drop off...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org