United States The dollar and US yields are recouping more of yesterday’s decline. A break of $1.0480-$1.05 would suggest the euro’s upside bounce is exhausted. A dollar move above JPY116.80-JPY117.25 would also hint that the greenback was going to make an other run toward JPY118.30-JPY118.60. Sterling support is seen in the $1.2285-$1.2310 area. The Canadian dollar is struggle to sustain it upward momentum. A US dollar...

Read More »FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

Swiss Franc EUR/CHF - Euro Swiss Franc, January 05(see more posts on EUR/CHF, ) - Click to enlarge The Swiss Franc has limited data releases to note for the upcoming weeks therefore I expect news from the Brexit story and UK economic data to influence exchange rates this month. At present we are awaiting the decision from the Supreme Court in regards to if UK Prime Minister Theresa May needs to seek Government...

Read More »FX Daily, January 04: Consolidation in Capital Markets

Swiss Franc EUR/CHF - Euro Swiss Franc, January 04(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has...

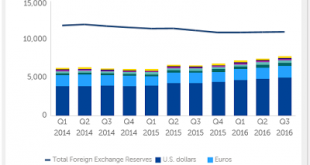

Read More »A Few Takeaways from the Latest IMF Reserve Figures

Summary: Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling’s share of new reserves warns it may be losing some allure. The IMF is the most authoritative source for reserve holdings of central banks. It reports the data at the end of each quarter with a quarter lag. At the end of last year, the IMF published the Q3 16 reserve figures. ...

Read More »FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

Swiss Franc Switzerland SVME PMI, December 2016(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge FX Rates The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling’s earlier losses were recouped following news that the manufacturing PMI jumped to...

Read More »FX Weekly Preview: What You Should Know to Start the First Week of 2017

Summary: Data has already been reported. Trends reversed in the last two weeks. US jobs data may disappoint. It will take a few more weeks to lift some of the uncertainty hanging over the markets. There are four things investors should know as the New Year begins. First, it has already begun with several PMI reports already reported. Second, in the last two week of the December, the trends that dominated Q4...

Read More »FX Daily, December 30: Dollar Slips into Year End

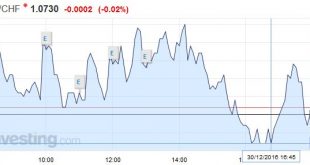

Swiss Franc EUR/CHF - Euro Swiss Franc, December 30(see more posts on EUR/CHF, ) The EUR/CHF remained close the SNB intervention point of 1.07. - Click to enlarge FX Rates In exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions. Before European markets...

Read More »FX Daily, December 29: Dollar, Equities and Yields Fall

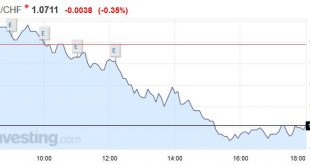

Swiss Franc EUR/CHF - Euro Swiss Franc, December 29(see more posts on EUR/CHF, ) - Click to enlarge FX Rates In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer. Some reports try to link the moves to the unexpected weakness in the US pending home sales, but this is a stretch and merely seeks to...

Read More »Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available. In the first clip (here), I discuss the dollar. I reiterate my forecast for the the Dollar Index to head toward 120.00. The consolidation between Q2 15 and end of Q3 16 appears to me to be the base of the new leg up that has already begun.[embedded...

Read More »FX Daily, December 28: Short Note for Holiday Markets

Swiss Franc EUR/CHF - Euro Swiss Franc, December 28(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Equities: Good day in Asia, where the MSCI Asia-Pacific Index rose 0.3% to snap a six-day slide. Of note the Hang Seng re-opening from a long holiday weekend rose (0.8%) from a five-month low. Chinese shares that trade in HK also did well, rising 1.5%. Indonesia, which broke a nine-day slide yesterday,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org