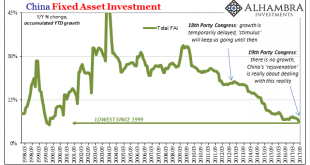

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied. Without any objection,...

Read More »Japan Is Booming, Except It’s Not

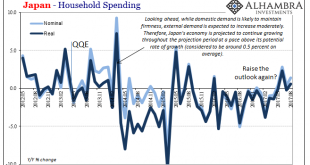

Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up: “Hopes for a global economic recovery and US shares’ strength are making fund managers generous on Japanese stocks,” said Chihiro Ohta, general manager of...

Read More »Political Economics

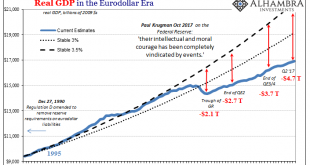

Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed. Still, politically, it does matter to some significant degree. It’s just that the political division isn’t...

Read More »Housing Isn’t Just About Real Estate

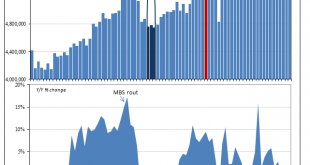

The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year. On an annual basis, resales in September were 1.5% less than those in September 2016. It was the first...

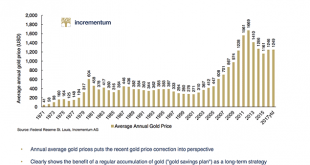

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

Read More »Distinct Lack of Good Faith, Part ??

It was a busy weekend in retrospect, starting with Janet Yellen and other central bankers uncomfortably facing a global media that has become (for once) increasingly unconvinced. Reporters, really, don’t have much choice. The Federal Reserve Chairman might not be aware of just how much she has used the “transitory” qualifier since 2015, but others can’t be helped from noticing. At the Group of Thirty’s International...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

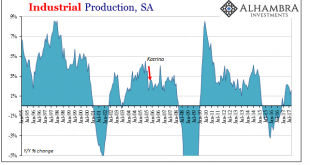

Read More »Broader Slowing in Industrial Production

Industrial Production rose 1.6% year-over-year in September 2017. That’s up from 1.2% growth in August, both months perhaps affected to some degree by hurricanes. The lack of growth and momentum, however, clearly predated the storms. The seasonally-adjusted index for IP peaked in April 2017, and has been lower ever since. This pattern, the disappointment this year is one we see replicated nearly everywhere on both sides...

Read More »Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months...

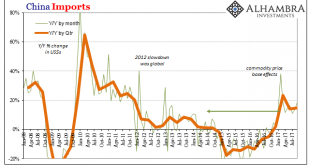

Read More »China Exports/Imports: Enforcing A Global Speed Limit

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month. What is becoming very clear is that China’s economy is behaving no differently than the global economy. Most of that increase for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org