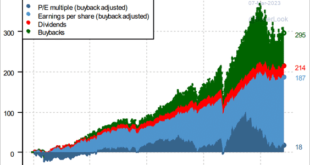

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote. “The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The decomposition of returns for the...

Read More »Digital Currency And Gold As Speculative Warnings

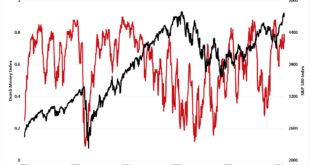

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites. “Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P...

Read More »Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies. From a portfolio management perspective, we must understand what happens during election years concerning the stock market and investor returns. Since 1833, the S&P 500 index has...

Read More »Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows. “New...

Read More »Macro: GDP Q3 — Inflationary BOOM!

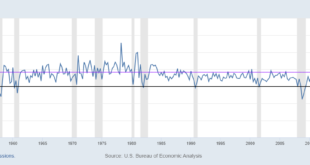

Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years. It was the best real growth quarter since Q2 and Q3 of 2014. The last 12 months has been mostly about services, here are the biggest contributors to YoY GDP: Consumption of Services Consumption of Goods Lower imports Government Non-residential investment in structures Intellectual property Q2 to Q3, we saw an acceleration in goods...

Read More »Macro: Philly Fed Mfg Survey — Umm

Tis was a poor number. The headline dropped from -5.9 to -10.5. The more eye popping number was the Index for New Orders which dropped from 1.3 to -25.6. I hate to say it, the diffusion index for new orders has never gone below 21 without an accompanying recession; that is until 2023. This is the 4th reading in the last 13 months below 21. These regional manufacturing surveys have been relatively poor since the middle of 2022. To date, it hasn’t mattered. Its as if...

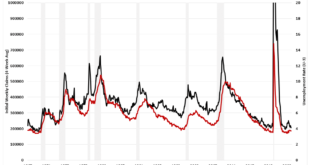

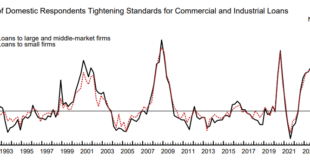

Read More »Macro: Banking: Senior Loan Officer’s Survey and Lending

Banks continue to tighten lending standards across all sectors. This has eased a bit from the July survey. Banks continue to widen spreads across all sectors. The percentage of banks widening spreads has also eased a tad. Banks are not seeing increasing demand for loans. I’m just posting survey results for C&I loans, the graph is very similar for commercial real estate, residential real estate and consumer loans. Commercial and Industrial loan growth has...

Read More »Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over? The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by more than a...

Read More »Macro: Employment Report

Wall street cheered the fact that we added fewer jobs (150,000) than expected (179,000) in October. This was a welcome relief after the hot September number that was revised down from 336,000 to 279,000. The Goods economy actually lost 11,000 jobs. The culprit here was motor vehicles and parts which was -33,000 on the month. The Services economy gained 110,000 jobs. 77,000 were in Health Care and Social Services. 10,000 were added to perming arts and spectator...

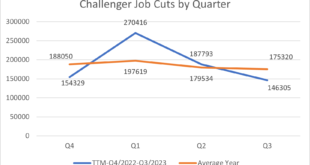

Read More »Macro: Challenger Job Cuts — Improvement throughout the year

We had a bad 1st quarter relative to historic averages for job cuts. But the situation has gotten better throughout the year. In the 3rd quarter of 2023 less people are losing their job relative to the average 3rd quarter going back to 1989. . Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the information herein constitutes an...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org