The Crazies Former Federal Reserve Chairman Alan Greenspan, who was once laudably referred to as “Maestro” for his supposed astute stewardship of U.S. monetary policy, commented last week on the nation’s current political and economic climate: “We’re not in a stable equilibrium. I hope we can all find a way out because this too great a country to be undermined, by how should I say it, crazies.”* Help! The crazies...

Read More »A Looming Banking Crisis – Is a Perfect Storm About to Hit?

Andy Duncan Interviews Claudio Grass Andy Duncan of FinLingo.com has interviewed our friend Claudio Grass, managing director of Global Gold in Switzerland. Below is a transcript excerpting the main parts of the first section of the interview on the problems in the European banking system and what measures might be taken if push were to come to shove. Andy Duncan of FinLingo.com (left) and Claudio Grass of Global...

Read More »US Stock Market – a Spanking May be on its Way

Iffy Looking Charts The stock market has held up quite well this year in the face of numerous developments that are usually regarded as negative (from declining earnings, to the Brexit, to a US presidential election that leaves a lot to be desired, to put it mildly). Of course, the market is never driven by the news – it is exactly the other way around. It is the market that actually writes the news. It may finally...

Read More »Interview with Doug Casey

Natalie Vein of BFI speaks with Doug Casey Our friend Natalie Vein recently had the opportunity to conduct an extensive interview with Doug Casey for BFI, the parent company of Global Gold. Based on his decades-long experience in investing and his many travels, he shares his views on the state of the world economy, his outlook on critical political developments in the US and in Europe, as well as his investment...

Read More »Evacuate or Die…

Escaping the Hurricane BALTIMORE – Last week, we got a peek at the End of the World. As Hurricane Matthew approached the coast of Florida, a panic set in. Gas stations ran out of fuel. Stores ran out of food. Banks ran out of cash. A satellite image of hurricane Matthew taken on October 4. He didn’t look very friendly. Image via twitter.com - Click to enlarge “Evacuate or die,” we were told. Not wanting to do...

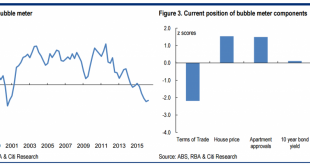

Read More »Australian property bubble on a scale like no other

Australian property bubble on a scale like no other Yesterday Citi produced a new index which pinned the Australian property bubble at 16 year highs: Bubble trouble. Whether we label them bubbles, the Australian economy has experienced a series of developments that potentially could have the economy lurching from boom to bust and back. In recent years these have included: the record run up in commodity prices and...

Read More »Australian property bubble on a scale like no other

Australian property bubble on a scale like no other Yesterday Citi produced a new index which pinned the Australian property bubble at 16 year highs: Bubble trouble. Whether we label them bubbles, the Australian economy has experienced a series of developments that potentially could have the economy lurching from boom to bust and back. In recent years these have included: the record run up in commodity prices and...

Read More »The Dying Middle Class

Largest Theft in History As expected, Ms. Yellen smiled last week, announcing no change to the Fed’s extraordinary policies. For the last eight years, she has been aiding and abetting the largest theft in history. Thanks to ZIRP (zero-interest-rate policy) and QE (quantitative easing), every year, about $300 billion is transferred from largely middle-class savers to largely better-off speculators, financial asset...

Read More »Credit Crisis in Waiting

Clowns in the Coliseum DUBLIN – The presidential debate began long after our bedtime, here in Ireland. So we got up this morning, rubbed our eyes, and watched the highlights. “Lowlights” is perhaps a better way to describe it: two rascals making public spectacles of themselves, arguing about things that mostly don’t matter… posing, posturing, pretending. If we had our druthers, both candidates would lose. That is...

Read More »The Fed and the Everything Bubble

John Hussman on Recent Developments We always look forward to John Hussman’s weekly missive on the markets. Some people say that he is a “permabear”, but we don’t think that is a fair characterization. He is rightly wary of the stock market’s historically extremely high valuation and the loose monetary policy driving the surge in asset prices. As he reminds his readers in this week’s market comment, he altered his...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org