Overview: Position adjustments ahead of today's US CPI and FOMC meeting are giving the dollar a modestly heavier tone today. Each of these events are typically a source of volatility in their own right and together they promise an eventful North American session. The yen is the only exception among the G10 currencies, but even there, the dollar is holding below yesterday's highs. Even sterling's relative resilience this week was unmarred by the flat April GDP. Led...

Read More »Dollar Trades Above JPY150 and Truss Gets No Reprieve

Overview: China and Japan continue to struggle to stabilize their currencies, while global interest rates rise. The offshore yuan has fallen to new lows but in late dealings the onshore and offshore yuan have recovered. The dollar also traded above JPY150 for the first time since 1990 and the market knows it is on thin ice as with the threat of official intervention. A risk-off mood permeates. Equity markets have retreated in the Asia Pacific region and Europe. US...

Read More »Riksbank Hikes 100 bp but the Krona gets No Love

Overview: Yesterday’s late rally in US shares carried into the Asia Pacific session where all of the large markets advanced. However, the bears are not abdicating and Europe’s Stoxx 600 is off for the sixth consecutive session and US futures are trading lower. The sell-off in the bond market continues. European benchmark yields are mostly 8-10 bp higher and the US 10-year Treasury yield is up nearly five basis points to approach 3.54%. The two-year continues to...

Read More »Money vs. Savings: Gluts, Current Accounts, Triffin, Capital Flow Correlations

On bankunderground, Michael Kumhof, Phurichai Rungcharoenkitkul, and Andrej Sokol question that foreign savings is an important driver of US current account deficits: Consider how US imports can be paid for in the real world: first, by transferring existing domestic or foreign bank balances to foreigners, which involves no new financing. Second, by borrowing from domestic banks and transferring the resulting bank balances to foreign households, which involves domestic but not foreign...

Read More »Financial Account and International Investment Position of Switzerland

On the SNB website, Lukas Heim and Christoph Kappeler explain the integration of the financial account, the international investment position and the Swiss financial accounts.

Read More »Brent’s Back In A Big Way, Still ‘Something’ Missing

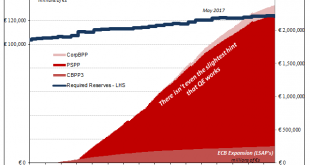

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status. Later on, governments...

Read More »Switzerland’s Changing International Linkages

In a CEPR discussion paper, Cedric Tille argues that Switzerland’s international linkages have been transformed over the last decade. Abstract: - Click to enlarge Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding...

Read More »Switzerland’s Changing International Linkages

In a CEPR discussion paper, Cedric Tille argues that Switzerland’s international linkages have been transformed over the last decade. Abstract: Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding robustly in recent years despite the European crisis and the strong Swiss franc. Second, the nature of...

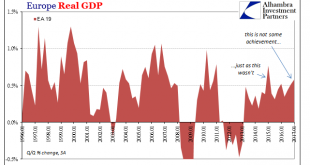

Read More »Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More »Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Update December 2016: Italians rejected the referendum that seeks to increase power of the prime minister and reduce power of the two chambers parliament. Prime minister Renzi has promised to resign. This opens the door for new elections, in which the anti-euro parties Movimento 5 stelle (5 star movement) and Lega Nord (Northern League) may strengthen. ————————————————————————————— Update December 2013: Bear in mind...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org