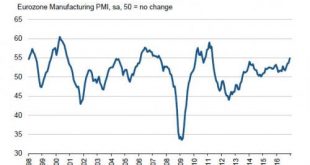

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April...

Read More »“Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money),” Die Volkswirtschaft, 2016

Die Volkswirtschaft 1–2 2017, December 21, 2016. HTML, PDF. Banning inside money creation would be unnecessary, insufficient, not enforceable, and besides the point. The way forward is to grant everyone access to central bank reserves and let investors choose between reserves and deposits.

Read More »“Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money),” Die Volkswirtschaft, 2016

Kosten eines Vollgeld-Systems sind hoch Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle. Der Präsident des Vereins Monetäre Modernisierung Hansruedi Weber (Mitte) und zwei verkleidete Aktivisten reichen im Dezember 2015 bei der...

Read More »Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Kosten eines Vollgeld-Systems sind hoch Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle. Der Präsident des Vereins Monetäre Modernisierung Hansruedi Weber (Mitte) und zwei verkleidete Aktivisten reichen im Dezember 2015 bei der...

Read More »The War On Cash Is Happening Faster Than We Could Have Imagined

Submitted by Simon Black via SovereignMan.com, It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos. But there have been...

Read More »“Wer hat Angst vor Blockchain? (Who’s Afraid of the Blockchain?),” NZZ, 2016

NZZ, November 29, 2016. HTML, PDF. Central banks are increasingly interested in employing blockchain technologies, and they should be. The blockchain threatens the intermediation business. Central banks encounter the blockchain in the form of new krypto currencies, and as the technology underlying new clearing and settlement systems. Krypto currencies bear the risk of “dollarization,” but in the major currency areas this risk is still small. New clearing and settlement systems benefit...

Read More »Bundesbank Considers Electronic Money

In the Welt, Karsten Seibel reports about the Bundesbank pondering over digital money. The Riksbank does the same.

Read More »eKrona

In the FT, Richard Milne reports about the Riksbank pondering to issue a digital currency. There are considerable questions for Sweden’s central bank to answer about how a digital currency would work. Would individuals have an account at the Riksbank? Would transactions be traceable, unlike with cash? Would emoney earn interest? Ms Skingsley said: “Personally I would like to design it in a way that is most like notes and coins.” That would mean no interest would be paid on it. But she...

Read More »Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX...

Read More »“Central Banking and Bitcoin: Not yet a Threat,” VoxEU, 2016

VoxEU, October 19, 2016. HTML. Central banks are increasingly interested in employing blockchain technologies. The blockchain threatens the intermediation business. Central banks encounter the blockchain in the form of new krypto currencies, and as the technology underlying new clearing and settlement systems. Krypto currencies bear the risk of “dollarization,” but in the major currency areas this risk is still small. New clearing and settlement systems benefit from central bank...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org