Despite US equity investors’ exuberance over bouncing crude oil prices, the world’s crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss next. Having urged investors “don’t panic” last year, and seeing dollar reserves drying up rapidly earlier this year, recent “lies” about the nation’s statistics have raised fears of a looming devaluation as FX forwards have crashed to 291...

Read More »Global Stocks Slide, S&P Set To Open Red For The Year As Hawkish Fed Ignites “Risk Off”

After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

Read More »OPEC Politics: Russian King, Iranian Crown Prince?

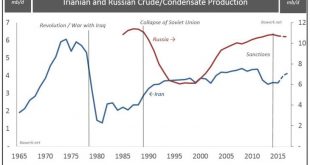

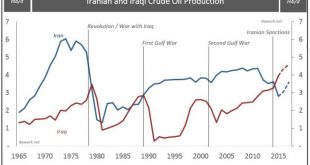

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town. It comes in the form of Russia; the number one global producer that’s not even technically a member of the cartel. Confused? Don’t be. The argument is quite simple. Irianian and Russian Crude/Condensate Production Iranian and Russian Crude/Condensate Production – click to enlarge. Unlike...

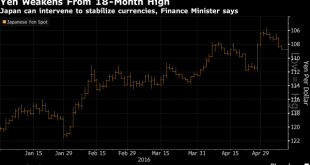

Read More »Global Stocks Jump; Oil Rises As Yen Plunges After Another Japanese FX Intervention Threat

In what has been an approximate repeat of the Monday overnight session, global stocks and US futures rose around the world as oil prices climbed toward $44 a barrel, with risk-sentiment pushed higher by another plunge in the Yen which has now soared 300 pips since the Friday post-payroll kneejerk reaction, and was trading above 109.20 this morning. At the same time base metals regained some of Monday’s steep losses following Chinese CPI data that came in line while PPI declined for 50...

Read More »The ‘Strange’ Death of Mr. Abadi

As expected, Iranian Prime Minister Abadi was always going to come off worse in his last ditch attempt to try and regain some kind of political initiative by appointing a new look ‘technocratic’ government in Baghdad. But the ailing Prime Minister has managed to back himself into a particularly tight corner after being outplayed by Muqtada al Sadr, Iyad Allawi and even Nouri Al Maliki. Rather than sticking to his ‘technocratic guns’ Abadi blinked first on cabinet changes, by allowing more...

Read More »Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and concentrated than before the financial crisis, energy loans being an accident waiting to happen, the markets having veto power over the Fed, and gold having more room to run. * * * Mr. Bianco, negative interest are causing a lot of stir at the...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More »Futures Jump On Chinese Trade Data; Oil Declines; Global Stocks Turn Green For 2016

With oil losing some of its euphoric oomph overnight, following the API report of a surge in US oil inventories, and a subsequent report that Iran's oil minister would skip the Doha OPEC meeting altogether, the global stock rally needed another catalyst to maintain the levitation. It got that courtesy of the return of USDJPY levitation, which has pushed the pair back above 109, the highest in over a week, as well as a boost in sentiment from the previously reported Chinese trade data where...

Read More »Japan Stocks Plunge; Europe, U.S. Futures, Oil Lower Ahead Of Payrolls

For Japan, the post "Shanghai Summit" world is turning ugly, fast, because as a result of the sliding dollar, a key demand of China which has been delighted by the recent dovish words and actions of Janet Yellen, both Japan's and Europe's stock markets have been sacrificed at the whims of their suddenly soaring currencies. Which is why when Japanese stocks tumbled the most in 7 weeks, sinking 3.5%, to a one month low of 16,164 (after the Yen continued strengthening and the Tankan confidence...

Read More »U.S. Futures Slide, Crude Under $39 As Dollar Rallies For Fifth Day

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org