The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year. On an annual basis, resales in September were 1.5% less than those in September 2016. It was the first...

Read More »The Market Has Its Head Buried Deep In The Sand

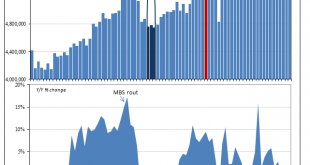

The Market Has its Head Buried Deep In The Sand Several “black swans” are looming which could inflict a financial nuclear accident on the U.S. markets and financial system. I say “black swans” in quotes because a limited audience is aware of these issues – potentially catastrophic problems that are curiously ignored by the mainstream financial media and financial markets. The most immediate problem is the Treasury...

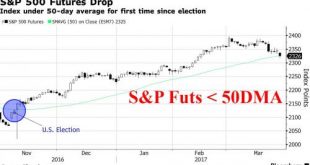

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More »Trumpflation Takes A Breather As Global Stocks Rise, Oil Jumps On Renewed OPEC “Deal Optimism”

With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

Read More »Consumer Sentiment Still Lukewarm

Bern, 03.11.2016 – The latest survey shows that there was hardly any change in consumer sentiment in Switzerland between July and October 2016*. The index currently stands at -13 points and has consistently come in at a value below its long-term average for over a year now. However, consumers believe that the outlook for the economy over the coming months is considerably better than in July. The assessment of price...

Read More »Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk

Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk – Sterling and euro have fallen sharply on fx markets– Gold bullion surged 20% in sterling to £1,015/oz– Gold now 15% in higher in GBP at £967 per ounce– Gold 8% higher in EUR and 5% higher in USD– Stocks globally are down sharply – FTSE down 9%– European stocks down sharply– Euro Stoxx 50 Futures collapsed over 11% at the open– Bank shares are down 20% to 25%– Cameron has resigned – adding to uncertainty in markets–...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

Read More »How Can Brazilian Exports Thrive Again?

The state of Brazilian exports has deteriorated over the last decade. The country has become more reliant on exporting raw materials compared to manufactured goods, and has suffered from the recent downturn in the prices of many commodities. Meanwhile, the cost of manufacturing goods in the country has surged over the past decade, rendering it less competitive in the global marketplace. How can the country compete more effectively? It must get back to its roots, said manufacturers at Credit...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org