Swiss Franc The Euro has risen by 0.19% at 1.1353 EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The positive impulse in the capital markets seen last week has faded. The gap higher opening ahead of the weekend by the S&P 500 was follow by a gap lower opening yesterday. The US threatened crackdown on Huawei disrupted...

Read More »FX Daily, January 28: Getting Ducks Lined Up for Later in the Week

Swiss Franc The Euro has risen by 0.05% at 1.1331 EUR/CHF and USD/CHF, January 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are consolidating ahead of this week’s big events, which include the FOMC meeting, US jobs, an important Brexit vote in the UK parliament and the first look at Q4 EMU and US GDP. The US dollar is narrowly...

Read More »FX Daily, January 18: Markets Finishing Week on Positive Note

Swiss Franc The Euro has fallen by 0.13% at 1.1311 EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF and USD/CHF, ) - Click to enlarge FX Rates Overview: Sentiment has improved since the volatility last month spooked investors and, perhaps, some policymakers. Global equities are rallying. The Shanghai Composite and the Nikkei are at their best levels in almost a month, while the Dow Jones Stoxx 600 is at...

Read More »FX Daily, January 17: Risk Assets Underperform as Investors Await Fresh Developments

Swiss Franc The Euro has risen by 0.32% at 1.1319 EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets remain relatively subdued as fresh trading incentives are awaited, including US corporate earnings. Some of the enthusiasm for risk-assets has diminished. The MSCI Emerging Markets Index has stalled after...

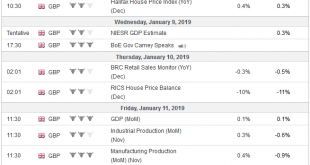

Read More »FX Daily, January 15: New Phase Begins with UK Vote

Swiss Franc The Euro has risen by 0.17% at 1.1272 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Several of the equity benchmarks are flirting with six-week highs, including MSCI Asia Pacific Index and the Emerging Markets Index. The Dow Jones Stoxx 600 is trying to extend its advancing streak for a third week, something not...

Read More »FX Daily, January 14: Dismal Chinese Trade Data Sets Tone

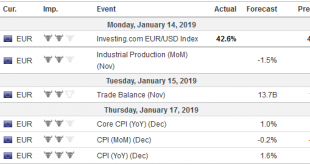

Swiss Franc The Euro has fallen by 0.33% at 1.1248 EUR/CHF and USD/CHF, January 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China’s exports and imports were weaker than expected, though the trade surplus swelled to its widest in a couple of years. The implications have undermined equities and weighed on risk appetites more broadly. Nearly all the...

Read More »FX Weekly Preview: Europe Moves to the Center Ring

In recent weeks, the macro story focused on the shifting outlook for Fed policy and the Sino-American trade relationship. There is unlikely to be further progress on either issue in the week ahead. The Fed won’t raise interest rates until toward the middle of the year at the earliest. The government shutdown will limit new readings on the US economy. US and Chinese officials just met. Mid-level Chinese officials can...

Read More »FX Daily, January 11: Trade Optimism and the Recovery in Oil Boosts Risk Appetites

Swiss Franc The Euro has fallen by 0.26% at 1.1287 EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimism on trade talks between the US and China coupled with the biggest rally in WTI in two years (11%+) have helped keep the equity market recovery intact.The MSCI Asia Pacific Index rose today, the eighth time in the past ten...

Read More »FX Weekly Preview: For the Millionth Time, Markets Exaggerate

The S&P 500 fell more than 12% in a few weeks. The 10-year Treasury yield fell nearly 40 bp. There were cries that the sky was falling. A recession is imminent, we are warned by prognosticators. The Fed went ahead and raised interest rates on March 21, 2018, and the S&P 500 proceeded to gap lower the next day and continued to sell-off the following day. Investors did not like the unanimous decision. Yet far from...

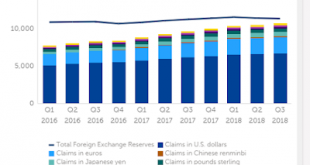

Read More »A Word on Q3 COFER-It Might not be What You Think

The IMF offers the most authoritative report on central bank reserves on a quarterly basis with a quarter lag. The report, the Currency Composition of Official Foreign Exchange Reserves (COFER), covering Q318 has been released. It may be have been overlooked during the holidays, but if and when the pundits see it, the leading takeaway is that the dollar’s share of global reserves fell below 62% for the first time five...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org