Poor economic data and soft inflation saw several central banks, including the Federal Reserve and European Central Bank, take a dovish turn in March. Contrary to expectations that interest rates would rise as the G3 central banks were no longer adding to their balance sheets on a combined basis. The sharp drop in interest rates and the flattening of curves in March is one of the key factors shaping the investment...

Read More »Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market’s sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month. Europe’s relationship with China will eclipse the US-China trade talks that resume with Mnuchin...

Read More »February 2019 PBOC/RMB Update

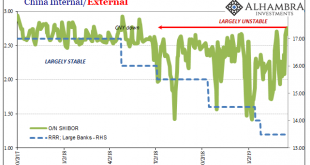

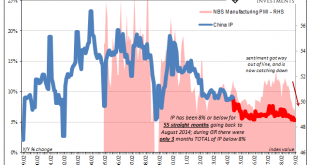

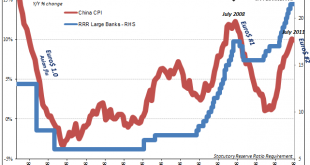

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions (here’s another). China...

Read More »No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before. Celebrating the milestone might’ve been the proposed purpose behind the state...

Read More »FX Daily, March 12: Wave of Optimism Sweeps through the Capital Markets

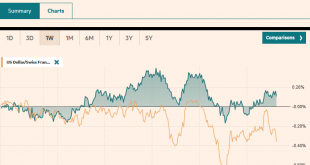

Swiss Franc The Euro has fallen by 0.03% at 1.1361 EUR/CHF and USD/CHF, March 12(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Last minutes statements meant to clarify what many MPs find to be the most odious part of the Withdrawal Bill, the backstop for the Irish border is goosed global equity markets even though it does not seem as if the Withdrawal Bill...

Read More »FX Daily, March 11: Greenback Starts New Week Decidedly Mixed, with Brexit Anxiety Weighing on Sterling

Swiss Franc The Euro has risen by 0.19% at 1.1347 EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asian shares recovered from opening losses to finish mostly higher, with the Shanghai Composite up nearly 2% and India tacking on 1% after the election was called, starting April 11. European markets, led by energy, communication, and...

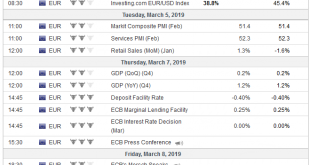

Read More »FX Daily, March 07: EMU Looks to ECB

Swiss Franc The Euro has fallen by 0.31% at 1.1324 EUR/CHF and USD/CHF, March 07(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ECB meeting is today’s highlight. A dovish signal is expected. The euro remains pinned near its lows ahead it. The global equity market rally in January and February is faltering this week. Asian equities were mixed, but the...

Read More »China Has No Choice

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China. This was amended in...

Read More »FX Weekly Preview: Dovish Hold by the ECB and Uptick in US Wages will Underscore Divergence

The important events take place in the second half of the week ahead: the ECB meeting and the US employment report. A dovish hold by the ECB is the most likely outcome. US jobs growth is bound to slow from the heady 304k gain in January, but there won’t be anything in it that lends credence to ideas that the world’s largest economy is on the precipice of a recession. The Brexit drama could be moving into its...

Read More »FX Daily, March 01: Could the Worst be Behind China and Germany? Or Hope Springs Eternal

Swiss Franc The Euro has risen by 0.14% at 1.1364 EUR/CHF and USD/CHF, March 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that MSCI plans to substantially boost China’s equity weighting in its indices and a better than expected Caixin manufacturing PMI and some easing of India-Pakistan tensions helped bolster the risk-taking appetite going into the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org