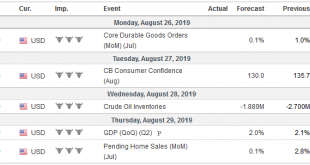

It’s the last week of August. Several economic reports will be released in the coming days. They include the US deflator of consumer expenditures that the Federal Reserve targets, China’s PMI, and the eurozone’s preliminary August CPI. It is not that the data do not matter, but investors realize the die is cast. They are looking further afield. The next US tax increase on Chinese imports goes into effect on September 1, and Beijing has threatened to retaliate. The...

Read More »FX Daily, August 22: Tick Up in EMU PMI Does Little, Waiting for Powell

Swiss Franc The Euro has risen by 0.17% to 1.0905 EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday’s 1.2% advance despite an unexpected gain in the EMU flash PMI....

Read More »That Can’t Be Good: China Unveils Another ‘Market Reform’

The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers. It wasn’t until October 2004, for example, that the upper limit on lending rates was rescinded. In August...

Read More »FX Daily, August 15: Animal Spirits Lick Wounds

Swiss Franc The Euro has risen by 0.18% to 1.0859 EUR/CHF and USD/CHF, August 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It took some time for investors to recognize that the scaling back of US tariff plans was not part of a de-escalation agreement. There was an explicit acknowledgment by US Commerce Secretary Ross that there was no quid pro quo. The US tariff split was more about the US than an overture...

Read More »FX Daily, August 14: Markets Paring Exaggerated Response to US Blink

Swiss Franc The Euro has fallen by 0.39% to 1.0862 EUR/CHF and USD/CHF, August 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US cut its list of Chinese goods that will be hit with a 10% tariff at the start of next month by a little roe than half, delaying the others until the mid-December. This spurred a near-euphoric response by market participants throughout the capital markets. However, as the news...

Read More »FX Daily, August 12: Yen Remains Bid, While Macri’s Loss in Argentina Weighs on Struggling Mexican Peso

Swiss Franc The Euro has fallen by 0.06% to 1.0883 EUR/CHF and USD/CHF, August 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China again tried to temper the downside pressure on the yuan, and this appears to be helping the risk-taking attitude. Many centers in Asia were closed today, including Japan and India, though most of the other equity markets advanced...

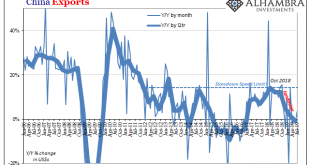

Read More »The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out. Even after all that supposed “stimulus” starting in the middle of last year...

Read More »FX Daily, August 8: PBOC Helps Stabilize CNY, while US Equity Recovery Lifts Sentiment

Swiss Franc The Euro has risen by 0.27% to 1.0948 EUR/CHF and USD/CHF, August 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The challenges for investors have not gone away, but a combination of factors has helped stabilize the capital markets. The PBOC set the dollar’s reference rate above CNY7.0, but not as high as anticipated, and this has seen the yuan...

Read More »Yes, the Dollar is Above CNY7.0, but No, the Sky is Not Falling

The world’s two great powers are at loggerheads. Chinese nationalism meet your sister, US nationalism. Import substitution strategy of Made in China 2025 meet your cousin Make America Great Again. Paradoxically, or dialectically, the similarities are producing divergent interests that extend well beyond economics and trade policy. Consider that the intermediate-range nuclear missile treaty between the US and Russia did...

Read More »FX Daily, August 7: Three Asian Central Banks Surprise Investors

Swiss Franc The Euro has fallen by 0.14% to 1.0918 EUR/CHF and USD/CHF, August 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: While investors keep a watchful eye on the dollar fix in China (a little firmer than projected) and tensions with the US, two other developments compete for attention. The Reserve Bank of New Zealand and the central banks of India and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org