Swiss Franc The Euro has fallen by 0.10% to 1.0999 EUR/CHF and USD/CHF, December 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Mostly better than expected manufacturing PMI readings for December, including in China, is providing the latest incentive for equity market bulls. Led by the Nikkei, which was aided by a weaker yen major equity markets in Asia Pacific rallied and recouped most of the nearly 1% loss...

Read More »FX Daily, November 29: Equities Slip While Investors Mark Time

Swiss Franc The Euro has risen by 0.21% to 1.1011 EUR/CHF and USD/CHF, November 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are trading heavily. Both the MSCI Asia Pacific and the Dow Jones Stoxx 600 snapped four-day advancing streaks yesterday and have seen some follow-through selling today. In the Asia Pacific region, all the markets fell but Jakarta. Hong Kong’s Hang Seng slipped a...

Read More »FX Daily, October 23: Markets Lack Much Conviction, Await Fresh Developments

Swiss Franc The Euro has fallen by 0.06% to 1.0999 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: UK Prime Minister Johnson is neither dead in a ditch as he said he would prefer to be than request an extension of Brexit, nor will the UK leave the EU at the end of the month. Yesterday’s vote rejected the attempt to fast-track the legislation needed to support the divorce...

Read More »FX Daily, October 22: Trudeau will Lead a Coalition Government in Canada, while the UK’s Johnson Fights Another Day

Swiss Franc The Euro has risen by 0.09% to 1.0999 EUR/CHF and USD/CHF, October 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Bismark is said to have warned that laws were like sausages, and to respect them, one ought not to see how they are made. The UK had a non-binding referendum more than three years ago, and although it won by 52%-48% and the party leaders committed to adhering to the results, it still...

Read More »FX Daily, September 04: HK Concession and Better EMU PMI Overshadows Self-Inflicted Trade and Brexit Woes

Swiss Franc The Euro has risen by 0.09% to 1.0835 EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites have been bolstered by three developments. The UK appears to have taken a tentative step away from leaving the EU without a deal. Hong Kong’s Chief Executive Lam has agreed to formally withdraw the controversial extradition measure that had been suspended. The...

Read More »Emerging Market Week Ahead Preview

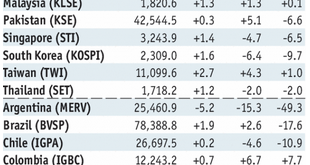

Stock Markets EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. Stock Markets Emerging Markets, August 29 - Click to enlarge Korea Korea reports August CPI Tuesday, which is expected to rise 1.4% y/y...

Read More »Emerging Markets: Week Ahead Preview

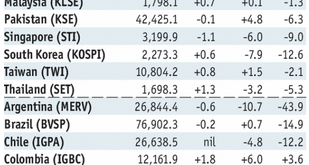

Stock Markets EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM. Stock Markets Emerging Markets, August 22 - Click to...

Read More »Emerging Markets: Preview of the Week Ahead

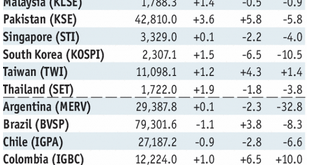

Stock Markets EM FX stabilized last week as the situation in Turkey calmed somewhat. Reports Friday that the US and China are hoping to resolve the trade dispute also helped EM FX ahead of the weekend. However, TRY remains vulnerable as the US threatens more sanctions due to the pastor. Both S&P and Moody’s downgraded it ahead of the weekend and our own ratings model points to further downgrades ahead. Turkish...

Read More »Emerging Markets: Preview of the Week Ahead

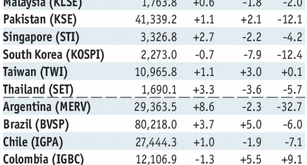

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX. Stock Markets Emerging Markets, July 25 - Click to enlarge South Africa South Africa reports June money, loan, and budget data Monday. June...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org