In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its...

Read More »Bi-Weekly Economic Review: Attention Shoppers

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports were clouded by negative undertones. So far though our market...

Read More »FX Daily, May 19: Markets Trying to Stabilize Ahead of Weekend

Judging from investors’ reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices. A fragile stability has enveloped the markets after US equities...

Read More »Trade Notes: China and Prospects for a New Executive Order

Summary: China’s trade concessions seem modest, but little discussion of US concessions. Reports suggest Trump is set to sign a new executive order to investigate trade practices in steel, aluminum, and maybe household appliances. Trade imbalances and floating currencies are not mutually exclusive. Last week’s meeting between the US and China’s Presidents did not produce much fireworks or headlines. The...

Read More »FX Daily, April 12: Investors Catch Breath, Markets Stabilize

Swiss Franc EUR/CHF - Euro Swiss Franc, April 12(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Markets are calmer today. The significant movers yesterday have stabilized. The dollar has been unable to resurface above JPY110, but after plumbing to new lows near JPY109.35 in Asia, the dollar has recovered back levels since in North America late yesterday. The decline in the US 10-year yield was...

Read More »FX Weekly Preview: A New Phase Begins

There were no celebrations; no horn or trumpets, nary a sound, but an important shift took place last week. The shift was signaled by two events. The first was the US strike on Syria, and the second was investors’ willingness to look past Q1 economic data. The US missile strike on Syria was significant even if it fails to change the dynamics on the ground. It undermines the Trump Administration’s ability to “reset” the...

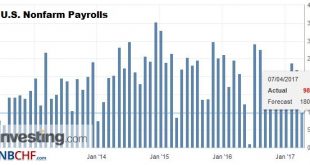

Read More »US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. United States Nonfarm payrolls The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job. U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm...

Read More »US Jobs Data Maintains Fed Hike Expectations

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: US jobs data was largely in line or better than expected. The stronger earnings growth may be more important than the headline. Canada’s data was mostly disappointing. The US October jobs report as a whole was in line with expectations, and suggests a...

Read More »Seven Things I Learned while Looking for Other Things

Summary: Mainland demand for HK shares has dried up this month. EMU growth may accelerate in Q4, while the collective deficit continues to fall. German fertility rate increased last year. Here is to the serendipity of learning: 1. Chinese buying of Hong Kong shares has dried up this month compared with the record equivalent of $8 bln in September. So far this month’s purchases are less than $1 bln. In...

Read More »Seven Things I Learned while Looking for Other Things

Summary: Mainland demand for HK shares has dried up this month. EMU growth may accelerate in Q4, while the collective deficit continues to fall. German fertility rate increased last year. Here is to the serendipity of learning: 1. Chinese buying of Hong Kong shares has dried up this month compared with the record equivalent of $8 bln in September. So far this month’s purchases are less than $1 bln. In...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org