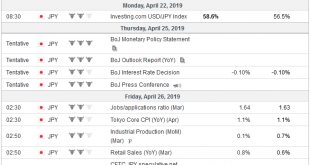

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan’s flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%). This coupled with the new cyclical...

Read More »FX Weekly Preview: What Can Bite You This Week?

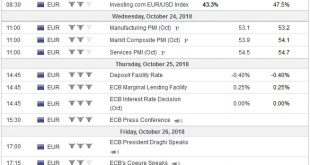

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets. Also, the...

Read More »‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are. Look to our...

Read More »FX Daily, May 18: EUR/CHF Continues the Collapse

Swiss Franc The Euro is down by 0.54% to 1.1743 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Reasons are: Weaker than expected euro zone GDP growth in Q1, in particular in Germany. However this “soft-patch” should have been clear to everybody. So it cannot be the main reason. Still the weak German GDP was the trigger for EUR weakness. A dovish European Central Bank. Already at the press...

Read More »FX Weekly Preview: Drivers and Views

It is not easy to recall another week in which there were so many potential changes to the broad investment climate. The relatively light economic calendar in the week ahead may allow investors to continue to ruminate about some of those developments. Here we provide thumbnail assessments of the main drivers. China The PBOC modified the way the reference rate is set. Currencies are allowed to trade in a band around...

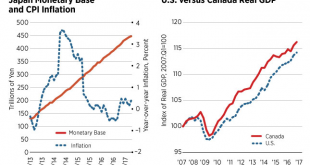

Read More »Why The Fed’s Balance Sheet Reduction Is As Irrelevant As Its Expansion

The FOMC is widely expected to vote in favor of reducing the system’s balance sheet this week. The possibility has been called historic and momentous, though it may be for reasons that aren’t very kind to these central bankers. Having started to swell almost ten years ago, it’s a big deal only in that after so much time here they still are having these kinds of discussions. My own view on the topic is the same as...

Read More »FX Daily, September 22: Markets Limp into the Weekend

Swiss Franc The Euro has risen by 0.05% to 1.1595 CHF. EUR/CHF and USD/CHF, September 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The cycle of sanctions, recriminations, and provocative actives continues as the Trump Administration leads a confrontation with North Korea. The US announced yesterday new round of sanctions on North Korea. Reuters reported that the...

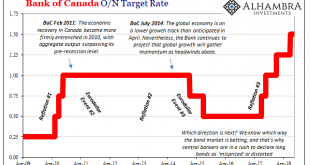

Read More »Canada’s RHINO(s)

The Bank of Canada “raised rates” again today, this time surprising markets and economists who were expecting more distance between the first and second policy adjustments. The central bank paid typical lip service to being data dependent. It has a vested interest if you, as any Canadian reader, believe that to be a fact. But what we really find in Canada is what we find everywhere else. The end of the “rising dollar”...

Read More »FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Summary: Following strong Q2 GDP figures, risk is that Bank of Canada’s rate hike anticipated for October is brought forward. ECB’s guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley’s comments are the most important. Four central banks from high income countries hold policy is making...

Read More »FX Daily, August 18: Dollar and Equities Trade Heavily Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.06% to 1.1279 CHF. EUR/CHF and USD/CHF, August 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The second largest drop in US equities this year has spilled over to drag global markets lower. The MSCI Asia Pacific Index fell nearly 0.5%, snapping a four-day advance and cutting this week’s gain in half. The Dow Jones Stoxx did not...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org